Pagina 22 di 30

Dati mercato greco (2006)

Dati ed informazioni sugli sviluppi del mercato greco

Greece - Foreword

Greece is the cradle of western civilisation. Democracy, philosophy, art, poetry and science all have their origins in the country.

Inspired by the past and empowered by the success of the OlympicGames, modern Greece is building a new image in the business world.The advantages of modern infrastructure, transport,communication andenergy facilities since the Olympics have created the right conditions forplacing the country at the centre of growing investment interest. The Games marked a milestone in the transformation of modernGreece. The first proper shopping centres have been developed andinvestment product of international standards has been increasinglyoffered to the market.

Greece, although a small country with 11 million inhabitants, is strategicallylocated between the important & fast developing geopoliticalmarkets of South Eastern Europe, a region with a population of over 160 million. Recent years have shown an increasing trend of institutional investorsseeking new horizons beyond their rapidly maturing home markets marking a new era for Greece.Cushman & Wakefield Greece, equipped with the most talentedprofessionals, is committed with great enthusiasm to supporting the market’s development, delivering professional real estate services tointernational standards, combined with the local experience.

Nicky Simbouras

Managing Director

Country Overview Greece is ideally placed geographically to form a gateway between Europe, the Middle East and Turkey, acting as a springboard into thiswider region.As Greece's neighbouring countries develop, the alreadyestablished business infrastructure will benefit further from this increasingly important consumer base.With Greece the only countryin the region which is part of the Eurozone, this will further aidGreece's positioning in the region.

The estimated consumer population of the Balkans and the Black Sea area is 320 million, with a GDP of USD 2,296 billion.The closer Balkanmarket consists of approximately 60 million consumers, of which 48million people live outside Greece's borders yet within 300 km of Thessaloniki, including countries such as Albania, Kosovo, the FormerYugoslav Republic of Macedonia (FYROM), Bulgaria, Romania, Serbiaand Montenegro.

The business environment in Greece has changed substantially over the last 10 years with privatisation and liberalisation of key industriessuch as energy, transport, and telecommunications helping to movethe country toward a thorough free market economy. This has aided investment in the telecommunications, manufacturing, energy, banking,services, trade, transportation and tourism sectors.The bulk of investments,in particular infrastructure projects, have taken place in the past five to six years (1999-2004), as political stability in the regionimproved and growth turned positive across South-East Europe.A vast under-provision of modern property has placed Greece on the

radar of both property developers and investors. Occupier demand is increasing steadily for modern space across all the commercial propertysectors, of which there is a general lack across the country.Themarket is expected to show good growth over the next few years, aided by the continued improvement of infrastructure projects thatare beginning to pay dividends subsequent to the huge investmentmade for the 2004 Olympic Games.

With a growing population, the residential market is expected to see impressive growth underpinned by increasing levels of available capital.Growth in demand in tourist-related coastal areas has been evenstronger meanwhile, with foreign interest concentrated in resorts along the Mediterranean and Aegean coastlines. A growing tourismmarket and relaxed investment regulations have encouraged somethingof a building boom in these areas, not only in residential developments but also in the hotel and leisure sectors as well.

Geography & People

Greece lies at the south-eastern tip of Europe covering approximately 132,000 sq.km. Its land border totals 1,228 km, with Bulgaria, Albaniaand The Former Yugoslav Republic of Macedonia (FYROM) to thenorth and Turkey to the east. Greece has 13,676 km coast line, with the Aegean Sea to the east of the mainland and the Ionian Sea to the west, with vast numbers of islands scattered throughout both.98% of the population are ethnic Greeks.The remaining 2% compriseof Turks, Pomaks, Jews,Armenians and various Roma groups.The only official language is Greek which is spoken by 99% of the populationwith English also widely spoken.The prominent religion is Greek Orthodoxy with 95-98% of Greekcitizens belonging to the Greek Orthodox Church. Muslims account for 1.3% of the population, mainly concentrated in the northernregion of Thrace. Roman Catholics, Protestants and Jews account forthe remainder. Mount Athos is recognised by the Greek constitution as an Autonomous Monastic Region and spiritually, Mount Athos isunder the Patriarchate of Constantinople.Greece is divided into 13 regions with 19% of the country's area accounted for by 3,000 islands. The climate is a temperateMediterranean one, with mild and rainy winters and hot, dry summers.Differences do exist across the country due to the country's topography, with 80% of the mainland accounted for by mountain chainsalong the central part of the country, with Mount Olympus the highestpoint at 2,917 m.The Attiki region and Eastern Greece are generally drier than the North and Western parts which see more rainfall.

History - Modern Greece

Greece was ruled by the Ottomans until 1821 when independence was first declared although not recognised until 1827 when the Ottomans were defeated at the battle of Navarino after a long anddrawn out struggle. In 1829 the Great Powers established one Kingdom of Greece which was finally recognised as an independentstate in 1830, with Ioannis Kapodistrias as President of the newRepublic.The republic was soon dissolved and a monarchy installed. Initially Greece's lands included the Peloponnese and the land masssouth of the Gulf of Volos. During the 19th and early 20th centuriesthis was extended, reaching its present configuration in 1947. Then followed turbulent times for the country. In 1917, during WWI,Greece sided with the Allies against the Axis Powers with the formernegotiating increased territory for Greece from the defeated Ottoman Empire whereby Greece was awarded Smyrna (modernIzmir).The Greco-Turkish War (1919-1922) followed and in 1922 theGreek army was defeated and Smyrna destroyed and large numbers of Asia Minor Greeks expelled from Turkey. In Greece itself there wasan army coup where high ranking officers were tried and executedand the King deposed.After ten years of republicanism, the monarchy was restored in 1935, but the King's acceptance in 1936 of a fascisttypedictatorship under General Metaxas, resulted in a damaging splitbetween monarchists and supporters of parliamentary democracy.

With the outbreak of WWII Greece suffered further. In 1940 the Italians, under Mussolini, demanded that Greece allow the Italiantroops to enter the country and surrender its arms. The Greekgovernment refused and a battle ensued with the Italians held back to Albania.The Germans then overran Greece in 1941 and forced theBritish to withdraw from the country. From 1942 conflict reigned withthe Germans until liberation in 1944. Civil war then broke out between the Communists and Monarchists which lasted until 1949when the former were defeated.In 1952 Greece joined NATO and the country enjoyed relative political stability and economic growth until the early 1960's. From 1965there was a period of governmental instability and intense politicalstrife which culminated in a military coup in 1967, forcing the King to leave and a military dictatorship was established. In 1974 the civiliangovernment was restored after the military junta fell as a result of itsunsuccessful coup in Cyprus against President Makarios, which aided the Turkish invasion of the island. In the same year a referendum votedagainst a return to constitutional monarchy and in 1975 a republicconstitution came into force. In 1981 Greece became a member of the then EEC and adopted the Euro in 2001.

Politics

Greece is a parliamentary democratic republic based on the 1975 Constitution. The prime minister and cabinet as well as the Vouli(parliament) play the central role in the political process.The presidentperforms some executive and legislative functions in addition to ceremonial duties.The last parliamentary elections held in March 2004 saw the centrerightNew Democracy party win a majority, with Costas Karamanlis president of the New Democracy party elected Prime Minister.The next parliamentary elections are due in March 2008.Whist there are a number of other political parties active, PASOK (Pan Hellenic Socialist Movement) is the dominant one.Political issues centre on relations with neighbouring Turkey, whichinclude hostility over historic events such as anti-Greek pogroms, territorial disputes in the Aegean and the as yet unresolved Cyprusissue, divided since 1974, with Turkey continuing to occupy 38% of thenorthern part of the island.

In 1996, tensions were high after a Turkish military invasion of the islets of Imia in the southeastern Aegean Sea. The crisis was diffusedafter intervention by the U.S. Relations have since improved after bothcountries suffered earthquakes in 1999 and offered each other help.Today Greece is a supporter of Turkey's struggle to join the EU.

Certain issues, however, remain at the forefront as Turkey still refuses to recognise the government of Cyprus and in May 2006 relationswere once again strained when a mid-air collision involving militaryplanes from both countries resurrected territorial disputes over sea and airspace. Recently public opinion has hardened somewhattowards Turkey's EU accession although support is likely to continue.Since the early 1990s, Greece has also been in dispute with the Former Yugoslav Republic of Macedonia, contesting the use ofthe name “Macedonia” by the neighbouring country as it implies aterritorial claim over Greece's own region of the same name.The UN is involved in continuing mediation efforts.

Economic Overview

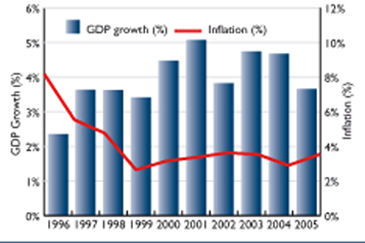

Greece is a small but open economy, which has experienced considerable growth in the past few years, supported primarily by its entryinto the Eurozone. Moreover, it has experienced increased consumerspending and buoyant investment levels because of its hosting of the Olympic Games in 2004.The nominal GDP in 2005 equalled a relativelysmall $225.4 billion, however in GDP per capita terms the countryreached $20,530 per person in 2005, lower than the EU25 average of $29,351. During the late-1990's, the economy experienced a currencycrisis resulting in double-digit inflationary rates. However it recoveredowing to the government's policies of fiscal consolidation and financial reform and, more importantly, the strength of domestic demand.Consumer spending was underpinned by the increased availability ofcredit and the lower interest rates following the introduction of the Euro. Foreign Direct Investment levels have also been buoyant, with anumber of multinational companies investing in the country, particularlyin the telecommunication, information technology and retailing industries.With GDP growth having reached 3.7% during 2005 and similar levels ofeconomic activity forecast over the next two years, this will enable the country to reap more benefits from economic catch-up. Furthermorethe Greek government's strategy, which focuses on strengtheningpotential growth and employment, should also advance the country's economic convergence with the EU.Although the country continues toface challenges such as high public deficits and low labour productivity,its relatively greater macroeconomic stability, continued policy of privatisation and gradual structural reform, place the country in aposition to become an important focus of investor activity.

Regions

Greece's capital, Athens, is the leading centre for commercial and industrial activity and accounts for the greatest proportion of regionalGDP, around 38.1% in 2005, primarily supported by the public andprivate service sector. It has developed from an administrative and cultural centre to a primary economic and trade centre, chiefly due toits relatively strategic location and superior communication and transportationfacilities.The hosting of the Olympic Games has also had a considerable impact on the prosperity and development of Athens.The thirteen regions (NUT II) can be further segmented into threegroups.The first group is amongst the most prosperous, with relatively rapid levels of growth. It consists of Athens, Central Macedonia and theisland regions of Crete, contributing 38.1%, 17.4% and 6.9% respectivelyto Greece's GDP.The second group are primarily the poor, remote and stagnant regions, and include Epirus, Western Greece andPeloponnesus. The remaining regions are all growing at a moderatepace. With the exception of Athens, Greece has significantly less regional disparity than a number of its EU counterparts. However,improvements in transportation and infrastructure through the EU'sCommunity Support Framework, should promote economic decentralisation, particularly in the poorer regions.

Current Trends The country has recorded robust growth over the past five years, particularly following its inclusion in European Monetary Union andthe hosting of the Olympic Games in 2004. GDP growth reached 3.7%in 2005, more than twice the growth rate of the Euro zone, boostedprimarily by buoyant growth in consumer spending and investment levels. Private consumption currently accounts for 66% of the country'sGDP and is expected to ease slightly over the outlook period. However, over the next five years, consumption growth is estimated to remain robust, driven mainly by favourable credit conditions and

Current Trends The country has recorded robust growth over the past five years, particularly following its inclusion in European Monetary Union andthe hosting of the Olympic Games in 2004. GDP growth reached 3.7%in 2005, more than twice the growth rate of the Euro zone, boostedprimarily by buoyant growth in consumer spending and investment levels. Private consumption currently accounts for 66% of the country'sGDP and is expected to ease slightly over the outlook period. However, over the next five years, consumption growth is estimated to remain robust, driven mainly by favourable credit conditions and

decelerated in 2005 as spending dropped off sharply in the wake of the Olympic Games, will see a revival in 2006 boosted by investmentincentives, privatisation programmes and the reduction of corporatetax rates. These two factors should continue to underpin economic activity, expected to average about 3.2% during the next five years.Unemployment levels are also expected to ease over the outlookperiod as labour reforms take effect.

Inflation, however, having been boosted by high energy prices and strong economic growth, remains above the Eurozone average,although an easing in price pressures is expected owing to therenewed appreciation of the Euro and moderating fuel prices in 2007.

The budget deficit remains stubbornly above the 3% minimum deficit target and is therefore a clear challenge for the government, despitehaving been reduced somewhat in 2005, suggesting a need for fiscaltightening going forward. National debt levels and the widening current account deficit are also major concerns going forward, bothhaving the potential to weaken the economy in the long-run.

Strengths & Weaknesses Of The Economy

Strengths

- Reform - The government is expected to continue to apply structural policies, albeit cautiously, over both the short and long-termacross several business and economic areas, boosting investment andeconomic stability. In general, these include tax, labour, privatisation and pension reforms. Tax reforms are coming into effect, albeit at alimited pace, that lower tax burdens for both households andcommercial enterprises, thereby stimulating investment. In addition, legislation has been passed that will enhance labour flexibility. In termsof pensions, the government is still facing pressure from the EuropeanCommission to launch a pay-as-you-go state pension system. Laws enforcing competition, the liberalisation of the public sector andPublic-Private partnerships have also been introduced and shouldenhance both economic growth and investment. Privatisation is becoming more widespread, with a number of programmes underway,such as the listing of the Postal Savings Bank on the Stock Exchange.

- Gradual Fiscal Adjustment - Policy is being implemented in order to secure long-term fiscal stability by establishing better and more efficientcontrols of public expenditure and reducing unnecessary publicspending.

- FDI potential - Greece experienced significant FDI growth in 2004, with levels doubling to equal 2.6% of gross fixed capital formation. Moreover, further potential for FDI growth exists whilst trade ties are expanding with the rest of the world.With new investment incentivelaws offering generous subsidies to private investment projects,combined with increasing macroeconomic stability and the government's willingness to push through necessary reform, considerableinvestment opportunities will exist over the next decade.

- Political environment - The current government is expected to remain in power until 2008, providing political stability and theexpectation of continued structural reform.

- Banking Sector - Recently buoyant economic activity has boosted profitability and capitalisation in the banking sector, making it a strongtarget for investment going forward. However, the potential rise ofhouse price inflation, and consequently an increase in the risk of default on personal debt, suggests an ongoing need for caution in the sector.

Weaknesses

- Debt and Deficits - Economic growth has been hampered by high levels of public debt (106.9% of GDP, 2005) and a large budget deficitwhich amounted to around -4.5% of GDP in 2005, above theMaastricht criteria's target of -3.0%.The rise in debt and deficit levels, more recently a result of public spending and infrastructureexpenditure for the Olympics, has created a need to implementconsiderable fiscal controls. In order to reduce these debt levels, the state needs to be acutely aware of its spending pressures, high debtservicingpayments and future pension costs.

- Inflation - The inflation rate has eased significantly in recent years although it may remain relatively high going forward, thereforepotentially restricting growth in the long-term and slowing the country'sconvergence with the EU-15 in terms of income per capita.

- Labour Force - The Greek labour market is still characterised by extremely high rates of unemployment, particularly amongst womanand young people and especially outside Athens and Thessaloniki.Policy initiatives have, however, been put into place in recent years in order to improve secondary education and to boost employment levels,which are forecast to increase in the medium term.

- Low Productivity - Economic growth is, to some extent, restrained by the country's limited human and capital resources. Much ofthe country's technology is somewhat outdated, whilst a significantproportion of the labour force is relatively unskilled. These problems are compounded by limited levels of business investment. Increasedproductivity growth is essential in order to enhance the level ofeconomic activity within the country.

INFRASTRUCTURE

Road

There is a good road network in all areas and national highways linking Athens with northern and southern Greece.In the run up to the 2004 Olympic Games, huge investments weremade in infrastructure projects.Two major projects were a ring road around Athens linking the international airport at Spata to the nationalhighway and the coast near Piraeus and a suspension bridge across themouth of the Gulf of Corinth, linking Rio and Antirio. Both projects have a positive impact on the property market with a number ofbusinesses relocating their accommodation in these more accessibleareas.

The new suspension bridge is linked at either end, currently poorly, but road upgrades include a package of six highway projects to bebuilt under PPP schemes. The projects include, among others, a newnorth-south motorway in the west of the country and new high speed links in the Peloponnese and the central plain. A number of other important infrastructure projects are underway; the Pathe highway, linking Patras via Athens to Thessaloniki and theEgnatia project stemming from Igoumenitsa in the north toThessaloniki and onto the Turkish border, the latter due for completion in late 2008.When finished, the motorway will reduce travelling timesacross northern Greece from the Adriatic to the Turkish border fromaround eleven hours to just six. Both projects were part funded by the EU.

Rail

Historically rail transport has been under funded as has The Hellenic Railways Organisation (OSE) and thus development of this mode hasbeen hampered. Rail links run from the south to the north, and thusthe south-eastern European hinterland is poor and under-used as a consequence. Improvements are being implemented to upgrade thenetwork, funded in the main by the EU's programme of trans-European networks (TENs). Whilst there are links from Thessaloniki in the north to the Balkan border, track conditions once across arepoor and make rail travel not the most efficient mode.The network in and around Athens is substantially better than the rest of the country as it received large investment in the run up to the2004 Olympic Games. The Athens metro was launched in 2000 andwhilst originally focused on the city centre, is now being extended into the suburbs.A major push for upgrading the system was the OlympicGames and a substantial amount of money has been spent on the system.Currently 4 lines operate, including a metrail extension to Athens International Airport. The significant extensions to the system willopen up the city further to the west and south, towards the futureMetropolitan Park (the old Hellinikon Airport site). The metro network, Suburban Railway not included, has a currentlength of 91 km and it is expected to reach 124 km (72 stations) bythe year 2009. Athens is also home to a 27 km tramway with an investment of Euro316 million that was completed ahead of the Olympics and links thecity centre with the southwestern suburb of Palaio Faliro, the southern suburb of Glyfada and towards the Piraeus district of Neo Faliro.Further extensions are planned towards the major commercial portof Piraeus and the southern suburb of Vouliagmeni.

The bus service consists of a huge network of lines operated by normal buses, electric buses, and natural gas run buses (the largest fleet ofnatural gas run buses in Europe).There are plenty of bus lines servingthe entire Athens Metropolitan Area.

Water

With 13,676 km of coastline and numerous islands Greece has a reported 123 cargo or passenger ports, 50 of which will be upgradedwith an investment of Euro 300 million.The main port location is at Piraeus which is one of the world's busiest ports and is located to the southwest of the mainland on theSaronikos Gulf.The commercial terminal has a throughput of 1.4 millionTEUs placing Piraeus among the top 10 ports in container traffic in Europe and the top container port in the East Mediterranean.Approximately 50% of the traffic is attributed to transhipmentcontainers. By 2007 the terminal will be connected by rail with the logistic centre in "Thriassio Pedio" and through this, with the Nationalrailway network, a fact which will upgrade it into an IntermodalTransportation hub. Thessaloniki is located on the northwest shore of the ThermaicosGulf and is the nearest European port for handling freight traffic toand from the Balkans, Eastern Europe and the Black Sea.

The Port of Patras is located in the north-west of the Peloponesse peninsula and is important in terms of linking Greece and Italy andNorth Africa. Whilst the port is used substantially for transportingpassengers, it also handles substantial amounts of cargo.

Volos is located at the head of the Gulf of Pagasitikos on the eastern Greek mainland. It is at the centre of Greece, allowing it to serve theentire country.The Port of Igoumenitsa is situated on the east side of the Corfu Channel, in Igoumenitsis Bay. It is considered the "Western" Gate ofGreece and facilitates maritime transport between Greece and Italy.It will be linked to the Egnatia highway, speeding up the movement of passengers and vehicles to Italy and the rest of Europe.

Air

The main, new international airport - Athens International Airport "Eleftherios Venizelos" (AIA) opened in 2001, replacing the old Athens(Ellinikon) International Airport. The new airport is located 33 kmsoutheast of Athens at Spata. It is accessible via Attiki Odos, a six lane motorway that makes up Athens City Ring Road.Athens and the Portof Piraeus are accessible via public transport by metro, railway andexpress airport buses. The airport was a Euro 2.2 billion investment and replaces the congested, centrally located previous airport. TheAIA project was a public-private partnership between the GreekGovernment and the private consortium led by Hochtief Aktiengesellschaft.The airport is ideally located to serve south east Europe, providingconnecting traffic from the eastern Mediterranean region, the Middle East, the Balkans, Africa and Greece to European and long hauldestinations. The current capacity is up to 16 million passengers and220,000 tons of cargo per annum, with potential expansion to raise passenger numbers to 50 million a year.In total, Greece has 39 international standard airports, many of whichhave been upgraded or rebuilt during recent years.The next five year plan includes expansion and renovation of 21 more airports, at a totalcost of more than Euro 400 million.

Telecommunications

Overall Greece has a modern telecommunications network that reaches all regions of the country. There are 6.4 million landlinesregistered and 3.8 million internet users. A staggering 97% of thepopulation own a mobile phone, served by the country's three largest mobile phone providers; Cosmote,Vodafone and TIM.The once state-owned Hellenic Telecommunications Organisation(OTE) was forced to reduce its monopoly in 2001, resulting in healthy competition in the sector. OTE now also operates in south-easternEurope and Middle Eastern markets as well.

Greece - A Market Summary

Real Estate

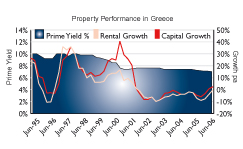

Over the last few years Greece has begun to move away from a market characterised by immaturity and one that was locally dominated, bothfrom an investor and occupier stand point.There is still some way to gobut the market is beginning to open up, offering a number of advantagesand is viewed to offer good potential. Additionally, as the neighbouringcountries to the north evolve, Greece is well placed for companies to locate in, serving these growing economies.The Greek market is small, with a limited number of large urban areas.However, the populations of Athens and Thessaloniki are relatively prosperous. Greece offers limited modern stock which satisfiesinternational occupier and investor requirements across all propertysectors. The market has been constrained by a tightly controlled development market, lengthy planning regulations and lack ofdevelopment expertise. However, the development market is startingto see increased levels of activity and a move away from the tightly overseen local market of the past. A number of multinationaldevelopers in both the commercial and residential sectors are nowactive typically in partnership or joint venture with a local firm. Investment procedures are changing with the establishment of theHellenic Centre for Investments (ELKE) to help streamline processesand they claim to have reduced the time to get investment approval to approximately three months, albeit with larger projects possiblytaking longer.There have, however, been reports that a further deterrentto foreign investment has been the influence of local businessmen using their contacts to delay or cancel projects, in particular withmodern developments in the leisure and tourism sectors.With further economic growth, the retail sector is faring the best and is receiving the greatest amount of foreign interest, especially in theshopping centre sector. Consumer tastes are evolving and acceptanceof new format retail is growing, supporting demand for modern space. However, traditional style high street retailing remains strong and isunlikely to diminish in the near future.There are opportunities in other sectors meanwhile, especially in the office and industrial sectors as public departments reorganise and theprocess of privatisation continues.With a strong and significant touristmarket meanwhile, coastal areas have seen a significant increase in interest in the leisure and hotel sector.This growth has also encouragedan increase in residential construction.

In the office sector the focus of activity is in and around Athens. The market is undersupplied and suffers from a severe lack of modernspace.With increasing demand for quality space from both nationaland international occupiers, the market should see some substantial developments in the near future.These are likely to be located alongnew and improved arterial routes where suitable development land isavailable and built properties accessible. Since Greece joined Europe's Economic and Monetary Union, theinvestment climate has changed quite considerably.The exchange raterisk is no longer an issue and this has opened up the market to a number of multinationals who are looking for opportunities to acquire propertiesthat on the whole are higher yielding that those in other partsof Western Europe. The development of the commercial property market will also be accelerated as the country's banking systemadvances. Until the last decade, the banking system was inefficient andconsequently Greece was less attractive than Spain or Portugal for example. Now however, current interest rates are low and securingcapital for investment purposes can be done with relative ease. IndeedGreece now has a relatively sophisticated banking sector, educated in understanding the difference between a viable development and onethat is unlikely to offer good returns.

Market Outlook

The outlook for the Greek property market is expected to be one of growth, although the pace is likely to be steady rather than dramatic.The market is still characterised by underdevelopment and limitedforeign investment, but the country offers considerable scope for growth simply as a function of the lack of modern supply which exists across all property sectors.Additionally whilst GDP and employmentgrowth are expected to slow over the next five years, it is still strongcompared to the European average. Business and financial servicessectors will drive output and new employment in the service sector is predicted to average around 9,000 new employees per year overthe next five years.There is increased emphasis on putting measures in place to make the market more transparent and deal with issues of bureaucracy andlengthy planning processes.Additionally the modernisation of existinglease structures to rebalance the current bias towards occupiers should be a focus.Traditionally the Greek market has received limited foreign interest asit has been dominated by national property companies and private, domestic investors. There has already been a significant change insentiment towards the market from international investors and occupiers with more investment and corporate activity.The market is becomingmore liquid and transparent and increased levels of both institutional and foreign investment is slowly emerging.With investment opportunities in Central Europe increasingly difficult tocome by and spending power in the Balkan countries still weak, Greece is an attractive alternative. Indirect investment is increasingly attractive andthis is likely to continue with the introduction of new REITs in the market.The focus will remain around the two major conurbations of Athens and Thessaloniki, although smaller regional cities may offer small scaleopportunities. Retail is the sector with the most growth potential andis likely to continue to be supported by a lack of modern retail space and good demand.There is space in the market for malls and leisurecomplexes, to attract multinational retail chains.In the office sector refurbishment is the key as planning regulation, especially in the city centre, is tight and there is a lack of suitable landplots. Peripheral areas will continue to grow and draw demand awayfrom congested city centres that additionally suffer from lack of adequate parking spaces. Occupier activity over the next twenty-fourmonths is likely to remain stable due to the continued consolidationand decentralisation of public departments. The vacancy rate will remain relatively stable as demand for space is likely to be counterbalancedby new development completions.With a lack of top specification industrial space, especially in the logistics sub sector, supported by an expanding retail market, rental levelsare expected to see some uplift over the next 1-2 years for top endprojects. Growth should also diversify away from being tightly located around Athens and Thessaloniki and activity will refocus along the newinfrastructure developments such as Attiki Odos.The leisure market should not be over looked and with a strong tourist industry there are opportunities for innovative schemes.There is a shift away from the typical hotel resort to integratedschemes including golf courses, spas and conference centres.

Investment activity in the sector is also supported by favourable tax incentives and government subsidies.A major new piece of legislation introduced in January 2006 is likelyto have an impact on the overall property market. VAT at 19% has been introduced on all properties with construction permits afterthat date to replace transfer tax for new properties. Compared to theold transfer tax of 11% this has made new construction effectively more expensive.The actual impact on the market has not yet been feltbut is not expected to be major, although demand for smaller sizednew-build properties and larger older properties is likely to increase.

Pre-let agreements are also likely to increase.

The Greek Property Market

OVERVIEW

Athens is very much the business and financial hub of Greece and as such, has the most active property market. Compared to Western andsome emerging Eastern European markets, Greece is relatively underdevelopedand immature, presenting numerous opportunities to thosewilling to invest. However, investors need to focus on medium termgains and must choose the right project and stay committed to it.The market is beginning to open up with the first quoted investmentcompanies, REICs now listed on the Athens stock exchange.

The government is also introducing legislation to stimulate investment in tourism and logistics as well as incentives for business investment.Both the main cities of Athens and Thessaloniki are home to relativelyprosperous populations who have an increasing appetite for newproperty concepts and, along with the modernisation of existing structures in favour of landlords, the outlook is bright. Additionallysince the hype of the Olympics in 2004, the country is now taking ona much more business-like approach and institutional investors are encouragingly beginning to like what they see.However, Greece comes with a lack of a sophisticated propertyregister and official data can sometimes be thin on the ground.Thereis a limited amount of modern stock satisfying international occupier requirements and a lack of development expertise across all sectors.

Tourism is of particular significance to the market, occupying a dominant position in the Greek economy. Over the last three decades Greecehas established itself as a popular tourist destination servicing allranges of the market. This in turn is boosting interest from both

domestic and international developers in the residential market, especially for luxury houses and villas in coastal areas.

Investment

InvestmentSince 2000 the Greek property investment market has seen steady growth but real volumes of transactions are severely constrainedby the scarce amounts of suitable stock. Notable increases wereregistered in 2005 which saw approximately Euro 233 million invested in major deals across the property sector. Investor interest remainsstrong with Euro 190 million invested during the first six months ofthis year.

Geographically the main focus for the office sector has and remains centred around the capital city of Athens. Developer/investor interestfor the retail and industrial sectors are again focused on Athens butwith Thessaloniki as a secondary area of interest.

Owner occupation dominates the market making it very difficult to source stock, although this is beginning to change and with it anincreased amount of foreign and developer interest is emerging.Traditionally private and domestic institutions have been the main investors. Foreign buyers remain relatively cautious and Greeceremains an immature property market especially for cross-borderinvestors, some of whom have expressed concerns regarding tenant friendly leases and bureaucratic planning and development processes.However, the first six months of 2006 saw the largest transaction todate in the Greek commercial property market involving a foreign investor. Lamda Developments signed an agreement with HSBCProperty Investments for the latter to acquire 49.23% of The Mall inAthens for Euro 135 million, reported a yield of 6.10%.

Significant domestic investors meanwhile include The Greek Orthodox Church, which enjoys tax advantages that private investorsdo not. Foreign investors to date include Rockspring, Pradera, LaSalleInvestment, Credit Agricole, UKA APN as well as Klepierre and Sonae Sierra.Opportunity for investors will also increase as organisations in thepublic sector begin to sell their properties, either directly with vacant

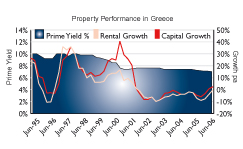

possession or through sale and leasebacks. Yields in the office and industrial markets have remained relatively stablein recent years. Although the  office market is beginning to see primeyields move in, they remain more comparative to Central Eastern markets rather than the Western European core markets and in somecases are now higher than in Central Europe. The is in part due toa weak occupier market and very limited investment stock. Industrial yields have also begin to move in since the end of 2005, although they are not expected to fall dramatically in the short term. Retail yieldshave seen the most downward shift as the market becomes moreattractive to both occupiers and investors and new formats and international retailers show increased levels of interest.Prospects for the market are generally good with further yield compressionexpected as well as rental growth for top end schemes across all sectors.Regional cities may begin to pick up although any growth will bemarginal.

office market is beginning to see primeyields move in, they remain more comparative to Central Eastern markets rather than the Western European core markets and in somecases are now higher than in Central Europe. The is in part due toa weak occupier market and very limited investment stock. Industrial yields have also begin to move in since the end of 2005, although they are not expected to fall dramatically in the short term. Retail yieldshave seen the most downward shift as the market becomes moreattractive to both occupiers and investors and new formats and international retailers show increased levels of interest.Prospects for the market are generally good with further yield compressionexpected as well as rental growth for top end schemes across all sectors.Regional cities may begin to pick up although any growth will bemarginal.

THE RETAIL MARKET

Sector Background

Greece is enjoying an active retail scene, with increasing levels of international players entering the market, fuelled by the completion ofmore high quality retail schemes.

The increase in the overall provision of quality space has been a significant factor in drawing these international retailers in, to set upoperations in the Greek market.The expansion of the retail marketsin both Athens and Thessaloniki have been aided by infrastructure developments that have significantly opened up the market to locationswhere previously establishing a unit would have been unfeasable.Trading hours are between 09.00 to 15.00 on Monday,Wednesday and Saturday (some high street areas operate until 18.00 on Saturday) and09.00 to 14.00 and 17.00 to 20.30 on Tuesday,Thursday and Friday.Allshops are closed on Sundays. However these are not rigorously enforced. Supermarkets are allowed to open from 08.00 to 21.00Mondays to Saturday. General opening hours are soon to be extendedto 09.00 to 21.00.This new legislation is likely to increase competition among the larger retailers.

Occupier Trends

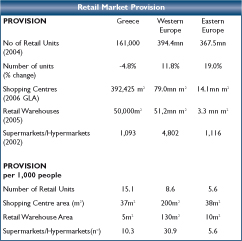

The Greek retail scene is quite fragmented, dominated by typically small shops in high street locations, owned and operated by individualcompanies. International retailers began to make an appearance in themarket in the mid 1990's led by the likes of the big hypermarket operators such as Carrefour. The majority of international retailersdo not yet have extensive networks of units and retail development ishighly concentrated on Athens and Thessaloniki, the two main cities of sizeable populations, and the domination of the high street will continueuntil more development of other formats come forward.

Since the late 1990s there has been growing interest from both national and international retailers, developers and investors, all lookingfor an opportunity to establish a foothold in the Greek retail scene.Their main focus has been in the shopping centre sector and schemes including leisure activities. Strict planning regulations and bureaucraticprocedures have hampered progress and few modern centres havebeen developed to date, small scale schemes dominating activity.

Since the late 1990s there has been growing interest from both national and international retailers, developers and investors, all lookingfor an opportunity to establish a foothold in the Greek retail scene.Their main focus has been in the shopping centre sector and schemes including leisure activities. Strict planning regulations and bureaucraticprocedures have hampered progress and few modern centres havebeen developed to date, small scale schemes dominating activity.

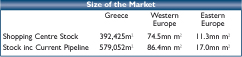

Shopping Centres

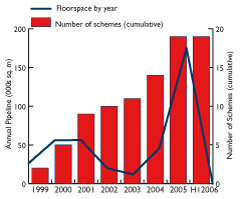

The Greek shopping centre market saw its first significant shopping centre openings in 2005: The Mall in Maroussi (Athens), City Link inAthens and Mediterranean Cosmos Centre in Thessaloniki.

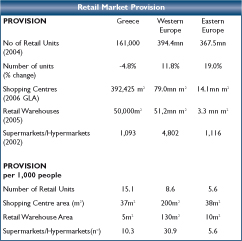

As a result of the current immaturity of the retail market, in-townlocations in Athens are still being exploited as shopping centrelocations, in addition to edge and out-of-town developments to servesuburban populations.The Olympic Games was viewed as a catalyst for retail developmentin the country, although several shopping centre schemes scheduled to be open in time for the Games were delayed, with developersfrustrated by often lengthy bureaucratic procedures.However, despite this slow emergence, the shopping centre market is expected to see a strong increase in development in the coming yearsto raise Greece's profile as an international destination for retailersand investors. Indeed while traditional high steet markets will remain competitive, potential for new development exists not only in Athensbut other regional cities as well. Greece has a total of approximately 392,000 sq.m which equates to 37 sq.m per 1,000 inhabitants - a figure closer to the EasternEuropean average of 38 sq.m and significantly lower than the WesternEuropean average of 200 sq.m per 1,000 inhabitants. There is just over 68,000 sq.m of space actually under constructionand a further 277,800 sq.m of proposed space in the pipeline until2009. On the assumption that all the space is brought to the market over the next 3 to 4 years, with consumer spending expected toremain relatively stable over the next twenty-four months, the marketis expected to be able to absorb the schemes will no pressure points of oversupply.

As a result of the current immaturity of the retail market, in-townlocations in Athens are still being exploited as shopping centrelocations, in addition to edge and out-of-town developments to servesuburban populations.The Olympic Games was viewed as a catalyst for retail developmentin the country, although several shopping centre schemes scheduled to be open in time for the Games were delayed, with developersfrustrated by often lengthy bureaucratic procedures.However, despite this slow emergence, the shopping centre market is expected to see a strong increase in development in the coming yearsto raise Greece's profile as an international destination for retailersand investors. Indeed while traditional high steet markets will remain competitive, potential for new development exists not only in Athensbut other regional cities as well. Greece has a total of approximately 392,000 sq.m which equates to 37 sq.m per 1,000 inhabitants - a figure closer to the EasternEuropean average of 38 sq.m and significantly lower than the WesternEuropean average of 200 sq.m per 1,000 inhabitants. There is just over 68,000 sq.m of space actually under constructionand a further 277,800 sq.m of proposed space in the pipeline until2009. On the assumption that all the space is brought to the market over the next 3 to 4 years, with consumer spending expected toremain relatively stable over the next twenty-four months, the marketis expected to be able to absorb the schemes will no pressure points of oversupply.

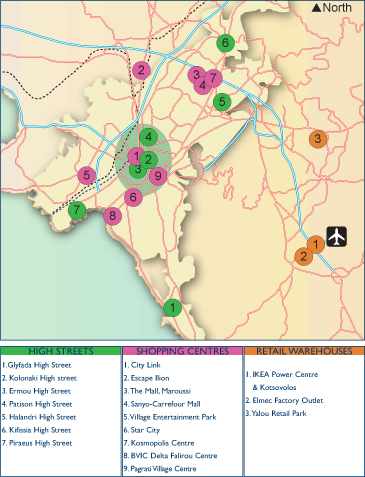

The City Centre Market

Traditional high street shopping is still very popular across Greece and will continue to compete with new format schemes such as shoppingcentres and retail warehouses for the foreseeable future.In Athens the most popular high street locations are the pedestrianised street of Ermou and the area surrounding Syntagnma Squareincluding Stadiou and Panepistimiou, Kolonaki Square and thesurrounding streets of Tsakalof, Skoufa and Patriarchou Ioakim. The northern suburb of Kifissia is also popular, with much of the pulldue to the affluent population who live there. Glyfada to the south isalso of equivalent importance. Voukourestiou Street, located in the city centre between Kolonaki andSyntagma square, is gaining importance as a high class retail pitch,where luxury brands such as Louis Vuitton,Todds, Cartier and Lancel are established. International retailer interest remains strong in Athens along the mainhigh street and there is sustained demand for prime units from a numberof large brands.With availability in these highly sought after locations limited, high premiums can be commanded.Thessaloniki, the second largest city and home to 1.2 million people,is the most significant retailing centre in the north of the country. Much of the retail here is still located within the city centre.The occupier market is performing well and whilst values havestabilized in the short term, the overall market has seen double digit growth in rental levels over the year-to-June. With quality unitsin short supply on the prime shopping streets, rental growth shouldcontinue, although the pace may slow.

Retail warehouses

There is little in the way of retail warehouse and factory outlet provision in the Greek market and therein lies potential opportunitiesfor real estate players who are willing to diversify into new formatretail that is likely to pay dividends in the longer term. Indeed, whilst from a low base there is now an increasing acceptance of new retailformats.There are only a handful of retail parks, although the ones in existence have proved to be quite popular with consumers. Typically they arelocated in more peripheral areas as land here is not only cheaper butmore available. The development of the sector will be aided by improved infrastructureprojects allowing ease of access.Indeed there are currently two parks in the pipeline both in the Greater Athens area. One is reportedly for IKEA who are looking toexpand their current operation located close to the new AthensInternational Airport at Spata and has enjoyed success. MacArthur Glen, meanwhile, will operate the first retail outlet in 2007 in theKantza area.

THE OFFICE MARKET

THE OFFICE MARKET

Sector Background

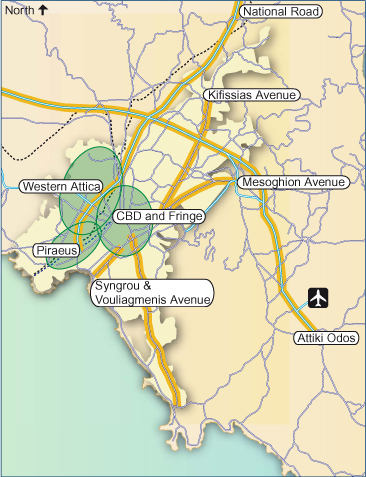

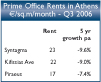

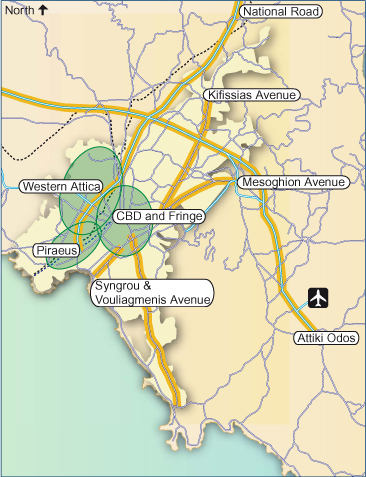

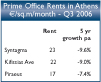

Athens is the dominant office market in Greece, followed by some way, by Thessaloniki. The majority of international companies onlyfocus their requirements on the Athens market.The much anticipated demand of the Olympics had less impact than expected on the property market overall.The most significant impactwas the investment made in infrastructure projects that have openedup some areas of the city.Whilst office availability was improved, with only about 20% of existing stock meeting international requirements,new space delivered for the Olympics has been absorbed, in the mainby the public sector.

As modern supply levels have falled back the office market is beginning to show some signs of stabilisation and could potentially see someupward rental growth in 2007 for selected areas. However, occupiersin the short term are likely to remain cost sensitive with growth focusing on better quality buildings with lower operating cost.

Occupational Demand

Over the last three years or so occupier activity has been relatively stable with between 120,000 and 150,000 sq.m of space transacted per year(although this includes owner occupier space which accounts of approximately50%). Accurate take-up levels however, are difficult to assess as there is a high proportion of off-market deals transacted directlybetween landlord and tenant. It is estimated that around 120,000 sq.mof space was taken off the market in 2004, with equivalent levels seen in 2005. With strong demand levels year-end totals for 2006 are expectedto see an increase on those recorded in 2004 & 2005.Underlying this level of activity is a drive for companies to consolidate their operations and look for cost effective solutions to their propertyneeds. Indeed, it should be noted that occupier activity should besustained for the next couple of years before levelling off as a major boost to the recent figures has been the reorganisation of the Greekgovernment relocating a number of ministries from the city centre tomore peripheral locations where cheaper, modern premises are available. At present both peripheral areas of the city and out-of-town locationsare popular. In these areas there is space to build modern developmentswith larger floor plates and adequate parking. The completion of transport infrastructure projects has aided levels of interest.There isOTE Building,Athens28

still demand for city centre locations with much of the focus being along Kifissias Avenue and the Attiki Odos area, stemming in the mainfrom multinational companies and some recent corporate merger andacquisition activity.  Rents are beginning to stabilise after three years of gradual decline and whilst further falls are not expected for centrally located space,levels may ease back in the more peripheral areas of the city andlocations such as Piraeus. However, out-of-town locations becoming more attractive and new developments coming online along the AttikiOdos for example, this is expected to attract more occupiers and anuplift in values should be seen. Thessaloniki is experiencing the same trend as the Athens market.Modern space in the city centre is almost non existent and the focusof interest is in peripheral areas of the city where there is increased parking and better access to the airport.There is limited demand forspace in the CBD and as occupiers are drawn away from the centre,availability levels have been increasing. The attraction of out-of-town areas has been aided by the Egnatia Odos project - a motorway linkingmajor locations across Northern Greece, making Thessaloniki moreaccessible overall.

Rents are beginning to stabilise after three years of gradual decline and whilst further falls are not expected for centrally located space,levels may ease back in the more peripheral areas of the city andlocations such as Piraeus. However, out-of-town locations becoming more attractive and new developments coming online along the AttikiOdos for example, this is expected to attract more occupiers and anuplift in values should be seen. Thessaloniki is experiencing the same trend as the Athens market.Modern space in the city centre is almost non existent and the focusof interest is in peripheral areas of the city where there is increased parking and better access to the airport.There is limited demand forspace in the CBD and as occupiers are drawn away from the centre,availability levels have been increasing. The attraction of out-of-town areas has been aided by the Egnatia Odos project - a motorway linkingmajor locations across Northern Greece, making Thessaloniki moreaccessible overall.

Supply

The overall vacancy rate is estimated to be between 8 - 9% and significantly lower at around 5% for modern stock. Much of the vacantstock is located in non-purpose built space offering small floor platesand space that is not cost effective to occupy. New developments are absorbed quickly as a result.There is an estimated 5 million sq.m of office stock across Athens,but only about 1.0 million sq.m can be classified as grade A and able to satisfy international occupier requirements. Refurbished spaceaccounts for approximately 1.5 million sq.m of the total stock andthere is a substantial amount of 'office' space located within residential buildings. The public sector also account for a large amount of officespace - occupying approximately 1 million sq.m.Historically the CBD was the most attractive area for businesses and received the most interest. Recently it has become less attractive due to high levels of traffic congestion, high levels of pollution, a severe lackof parking facilities and regulation restricting city centre access.Additionally occupier requirements have changed and with much ofthe CBD stock built in the 1950’s and 1960’s the typically small floor plates (under 500 sq.m) no longer satisfy these changing occupierdemands in the market. Supply levels in the CBD for top quality space are likely to remainlimited and the dynamics are unlikely to change in the near term asland shortages and planning regulations prevent increased development.

Any new developments are either pre-let or taken up very quickly. The area is still relatively popular with legal and financial companies,with the Athens Stock Exchange and various government ministriesstill located there. An additional point to note is that buildings in the city centre typicallyhave multiple owners which impacts on the maintenance and managementof the buildings. Elsewhere in Athens meanwhile, there are significant amounts of officespace located along the key roads of Kifissias Avenue and MesoghionAvenue, both thoroughfares between the CBD and the north and north eastern suburbs of Athens. With the Olympic Stadium andMedia Village close to Kifissias Avenue, the area received peak levels ofinterest in the run up to the Olympic Games. Mesoghion Avenue is the older of the two locations and has greater amounts of class B and Cspace and as such lower levels of demand. Limited constructionis expected in this area as there is very limited land available for development, although the refurbishment of older space may increase.Syngrou Avenue runs between the city centre and the southern suburbs.The area is home to a number of companies involved in the IT and pharmaceutical sectors as well as insurance and shipping companies.Recently the area has seen substantial redevelopment and refurbishmentof older buildings, making it more attractive, especially to those companies that require access to the city centre.With a limited number of sizeable developers in the Greek market,dramatic short-term changes in stock are unlikely. Additionally, international developers are trying to enter the market but both localand international companies are hampered by the lack of land in thecurrent office locations and any sites that may be available are expensive.

The Olympic facilities still to be assigned for new purposes are due to be leased, although this will not ease the undersupply in the officemarket as 90% of the space has been designated for retail use.Thessaloniki suffers severely from a congested city centre and supply, whilst evident, is not in great demand. Major infrastructure projectsincluding the creation of a 13 station metro and the City Hall projectcreating 870 parking spaces and office premises which should relieve some pressure, and attention may well begin to return to the centrein the longer term.

Development Trends

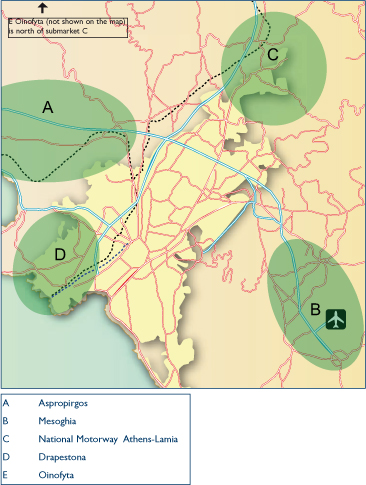

New transport infrastructure has fundamentally changed the office market in Athens. Peripheral and out-of-town office markets havebecome attractive locations providing occupiers with an opportunityto occupy modern offices, in accessible locations, at lower rents. Stock in Athens has been increasing gradually and the market is verylocally controlled, with the number of international developers limited.There are additional hurdles of a planning system that can be lengthy and bureaucratic.Developers continue to approach the market with an air of cautionand are reluctant to build on a purely speculative basis, preferring to secure pre-let agreements before commencing construction.However, due to the severe lack of international grade stock, morespeculative developments are being seen, although absorbed with relative ease. Since 2002 only around 380,000 sq.m has been added to themarket, with 2005 recording about 95,000 sq.m, much of which waspre-let. New schemes coming through are delivering much needed large floor plates meanwhile.New 'hubs' within the office market are beginning to emerge as investmentin infrastructure projects open up the Greater Athens region and begin to reshape the structure of the Greek office market. Significantnew areas of interest are those located along the Attiki Odos andsecondly the Athens Lamia National Road. Planning issues do not allow a large amount of sites in these areas to be developed. Majoroccupiers along the Attiki Odos include Ericsson, Schering Plough,Toyota and Bristol Myers Squibb whilst Siemens, Ernst & Young and Coca Cola have located along the National Highway.Vouliagmenis Avenue is making a comeback meanwhile and was oncea popular office location, supported in the main by the proximity to the old airport. Since its relocation, the area has lost some of its prestigebut with the redevelopment of the old airport site on the cards, thearea is likely to see growth over the longer term.The redevelopment into the Metropolitan Park scheme will cover 530 hectares andinclude leisure and residential space.

OFFICE MARKET DATA: A Summary

Stock

At the end of Q2 2006, whilst definitive figures do not exist, stock is estimated to be around 5 million sq.m across the Greater Athensregion, with 20% estimated to be grade A. The majority of stock islocated in the CBD submarket and along arterial routes running north to south, notably Kifissias Avenue to the north and Syngrou Avenue tothe south.

Availability

With a severe lack of quality space, availability at the top end of the market remains tight with overall vacancy rates hovering between8-9%.Availability is easing back as older stock is either refurbished tohigher standards and then occupied or removed from the market and redeveloped as residential space for example.

Development

The current amount of space under construction is between 100,000- 150,000 sq.m, with almost a third specifically designed for owneroccupation. New developments rarely reach the market without havingsecured at least one occupier.

Out-of-town and peripheral areas are the current focus of activity.

Take-up

Occupier activity ranges from between 120,000 - 150,000 sq.m per year, driven in the main by consolidation and companies exchangingspace in a pressurised rental market.The reorganisation of public ministries has also played an important role in recent years.

Sector Background

Sector Background

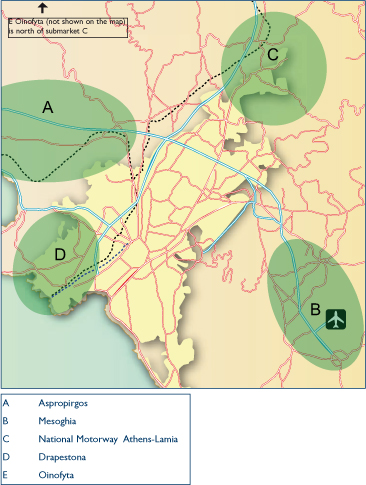

The industrial market in Greece is underdeveloped and owner occupation is very common. The logistics/distribution market in particular lagsbehind, although it is beginning to see increased levels of interest asmarket dynamics change and impact on supply and demand.There are two main focal points to the market: Athens in the southand Thessaloniki in the north.Athens is the major market, being boththe country's capital and economic centre, with almost 30% of thepopulation living there.The active Port of Piraeus is also nearby and isone of the largest container ports in Europe and thus a significantfocus for both national and international distribution. Thessaloniki isGreece's second largest city and seaport. Historically the port has been relatively isolated from the rest of the EU and not such anattractive location but, is now becoming increasingly important inserving the Balkan region.

Occupational Demand

Greece's industrial market is relatively immature and the quality ofstock lags behind the more mature markets of Western Europe.However, with occupier demand generally on the rise and new international requirements, there is increased pressure to deliver high quality, top specification space in well located, accessible areas. Additionally pressure is being exerted by an expanding retail sector which has an increasing need for distribution warehouses.Third party outsourcing is more popular as companies restructure and merger and acquisition activity continues, both supporting healthy levels of demand. Domestic players currently account for the lion's share of demand but this is gradually changing as the market opens up. Indeed more foreign operators are taking an interest in establishing operations in Greeceand are increasingly driving the development of the market. Key areas

of interest are close to major arterial roads such as Attiki Odos and the National Highway in Athens, allowing for the efficient transportationof goods around the country and to strategic ports without the needto negotiate the congested roads of Athens City.Prime rental levels are down approximately 15% from their peak in2001 - 2002 but have been stable over the last twelve months or so.Rents have fallen as the range of potential locations has been openedup by infrastructure developments and, additionally, governmental incentives drawing companies away from the city centre to moreperipheral areas, where development costs are lower. Sustaineddemand may well put pressure on rental levels, in 2007, particularly given a preference for leasing rather than owning. There are two dominant types of requirements in the market.The firstis for space between 3,000 - 5,000 sq.m suitable for those companieslooking to consolidate their operations into more efficient buildingsthat are cost effective. The second is for large scale schemes over15,000 sq.m that are suitable for retailers such as supermarkets.

Supply

Overall supply levels remain limited in a market that is characterised by owner occupation.Any existing availability is found mainly in small,older stock that does not meet international requirements. However,these do present redevelopment opportunities and any new space

delivered to the market is absorbed with relative ease as was the 280,000 sq.m released after the Olympics in 2004.Across the Greek market schemes continue typically to be constructedon a built-to-suit basis with limited speculative space in the development pipeline. However, the market dynamics are changing and as suchmore speculative space is being developed especially along the newarterial routes where demand for logistics and storage space is high and are areas that are receiving large investment at the moment.Construction is continuously being pushed to more peripheral areasas a result of planning regulations and land availability.

The majority of construction in and around Athens at the moment is to the west of the city in areas such as Elefsina, Aspropirgos andMandra which allow easy access to the north, west and south of thecountry. In the north locations such as Lalohori, Sindos and New Malgara to the west of Thessaloniki are popular as they give access tothe south as well as the bordering countries to the north of Greece,whilst drawing on the skill base resident in Thessaloniki. Supply may be eased slighty in Athens as reportedly the governmenthas put out a tender for 240,000 sq.m of logistics space to be developedin Thriasio, next to the Attiki Odos, in the western suburbs of Athens. This will additionally aid infrastructure developments and open up theareas to the west a little more.

Development Trends

Greece's industrial market remains immature and under developed, thereby presenting opportunities to developers and investors alike as occupier interest steadily increases.Additionally the country's exports to its neighbours, especially the Balkan countries, are expected to increase and thus add to the development of the market and the establishment of key hub markets within the country. The neighbouring economies will also improve in the run up to some entering the EU and this will create further demand from international companies for modern, high specification space. At the same time however competition may also increase from these Eastern European countries. For example Microsoft recently reported that it plans to open a logistics centre in Bulgaria from where it will serve clients from all Balkan countries, including Greece. The expansion of retailers and increased levels of outsourcing are expected to continue which will in turn drive demand and development activity for logistics platforms. New formats and robust consumer spending should generate strong demand growth among retail and distribution operators. Sophistication will further be aided by government subsidies which are offered for the development of large-scale distribution facilities, supporting investment in the sector and playing a significant role in establishing industrial hubs across the country. Government incentives in particular continue to encourage operators to locate outside the Greater Athens area in more decentralised areas. Indeed, whilst previously inaccessible, with investment in transport links such as the National Road and Athens Ring Road continue to act as a catalyst for the creation of modern warehousing facilities and the expansion of the sector. Moreover, as manufacturing improves, large purpose-built distribution and logistics facilities are beginning to emerge supporting the ports and the new international airport at Spata. Large scale investment in infrastructure projects will continue to open the market and spur the development of the overall Greek industrial market, funded in part by the EU. However, there are still large areas of the country that suffer from poor accessibility as the focus of the projects has been Athens and Thessaloniki. In certain areas land prices have also become expensive as the restrictive planning has meant that large sites suitable for a distribution hub trade at a premium. It has also been reported, rather ambitiously perhaps, by the Development Minister that twenty industrial zones will be created by the end of 2007.Two of the zones will be on the island of Crete. The Ministry will spend Euro 173 mn on the extension and upgrade of another 27 industrial zones in the country, with

substantial funding under the Operational Programme "Competitiveness" of the EU's Third Community Support Framework.

Current Trends

Current Trends

Investment

Investment office market is beginning to see primeyields move in, they remain more comparative to Central Eastern markets rather than the Western European core markets and in somecases are now higher than in Central Europe. The is in part due toa weak occupier market and very limited investment stock. Industrial yields have also begin to move in since the end of 2005, although they are not expected to fall dramatically in the short term. Retail yieldshave seen the most downward shift as the market becomes moreattractive to both occupiers and investors and new formats and international retailers show increased levels of interest.Prospects for the market are generally good with further yield compressionexpected as well as rental growth for top end schemes across all sectors.Regional cities may begin to pick up although any growth will bemarginal.

office market is beginning to see primeyields move in, they remain more comparative to Central Eastern markets rather than the Western European core markets and in somecases are now higher than in Central Europe. The is in part due toa weak occupier market and very limited investment stock. Industrial yields have also begin to move in since the end of 2005, although they are not expected to fall dramatically in the short term. Retail yieldshave seen the most downward shift as the market becomes moreattractive to both occupiers and investors and new formats and international retailers show increased levels of interest.Prospects for the market are generally good with further yield compressionexpected as well as rental growth for top end schemes across all sectors.Regional cities may begin to pick up although any growth will bemarginal.

Since the late 1990s there has been growing interest from both national and international retailers, developers and investors, all lookingfor an opportunity to establish a foothold in the Greek retail scene.Their main focus has been in the shopping centre sector and schemes including leisure activities. Strict planning regulations and bureaucraticprocedures have hampered progress and few modern centres havebeen developed to date, small scale schemes dominating activity.

Since the late 1990s there has been growing interest from both national and international retailers, developers and investors, all lookingfor an opportunity to establish a foothold in the Greek retail scene.Their main focus has been in the shopping centre sector and schemes including leisure activities. Strict planning regulations and bureaucraticprocedures have hampered progress and few modern centres havebeen developed to date, small scale schemes dominating activity.

As a result of the current immaturity of the retail market, in-townlocations in Athens are still being exploited as shopping centrelocations, in addition to edge and out-of-town developments to servesuburban populations.The Olympic Games was viewed as a catalyst for retail developmentin the country, although several shopping centre schemes scheduled to be open in time for the Games were delayed, with developersfrustrated by often lengthy bureaucratic procedures.However, despite this slow emergence, the shopping centre market is expected to see a strong increase in development in the coming yearsto raise Greece's profile as an international destination for retailersand investors. Indeed while traditional high steet markets will remain competitive, potential for new development exists not only in Athensbut other regional cities as well. Greece has a total of approximately 392,000 sq.m which equates to 37 sq.m per 1,000 inhabitants - a figure closer to the EasternEuropean average of 38 sq.m and significantly lower than the WesternEuropean average of 200 sq.m per 1,000 inhabitants. There is just over 68,000 sq.m of space actually under constructionand a further 277,800 sq.m of proposed space in the pipeline until2009. On the assumption that all the space is brought to the market over the next 3 to 4 years, with consumer spending expected toremain relatively stable over the next twenty-four months, the marketis expected to be able to absorb the schemes will no pressure points of oversupply.

As a result of the current immaturity of the retail market, in-townlocations in Athens are still being exploited as shopping centrelocations, in addition to edge and out-of-town developments to servesuburban populations.The Olympic Games was viewed as a catalyst for retail developmentin the country, although several shopping centre schemes scheduled to be open in time for the Games were delayed, with developersfrustrated by often lengthy bureaucratic procedures.However, despite this slow emergence, the shopping centre market is expected to see a strong increase in development in the coming yearsto raise Greece's profile as an international destination for retailersand investors. Indeed while traditional high steet markets will remain competitive, potential for new development exists not only in Athensbut other regional cities as well. Greece has a total of approximately 392,000 sq.m which equates to 37 sq.m per 1,000 inhabitants - a figure closer to the EasternEuropean average of 38 sq.m and significantly lower than the WesternEuropean average of 200 sq.m per 1,000 inhabitants. There is just over 68,000 sq.m of space actually under constructionand a further 277,800 sq.m of proposed space in the pipeline until2009. On the assumption that all the space is brought to the market over the next 3 to 4 years, with consumer spending expected toremain relatively stable over the next twenty-four months, the marketis expected to be able to absorb the schemes will no pressure points of oversupply.  THE OFFICE MARKET

THE OFFICE MARKET

Sector Background

Sector Background