Franchising, retail, business

29/07/2014

Small business loans may be getting easier to obtain, but 77 percent of entrepreneurs who started a business in the past ten years say they haven't bothered applying for one.

Despite reports that small business loans are becoming easier to obtain, most young startups don’t apply for them, according to a survey from Sageworks, a financial information company.

When asked if they had ever applied for a loan for their business (including personal loans), just under 77 percent of small business owners said they had not. All businesses surveyed were less than 10 years old.

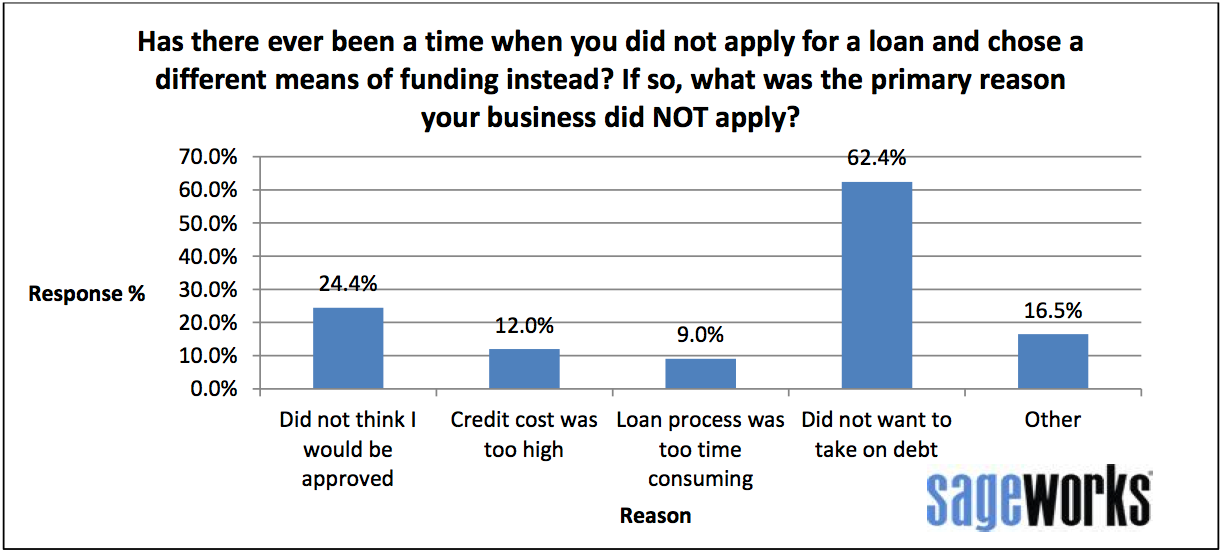

The survey also asked small business owners why they chose other means of funding over business loans. Sixty-two percent of respondents said it was because they did not want to take on debt, and 24 percent said they did not believe they would be approved for a loan. Twelve percent thought the cost of credit was too high, while nine percent said the loan process was too time-consuming.

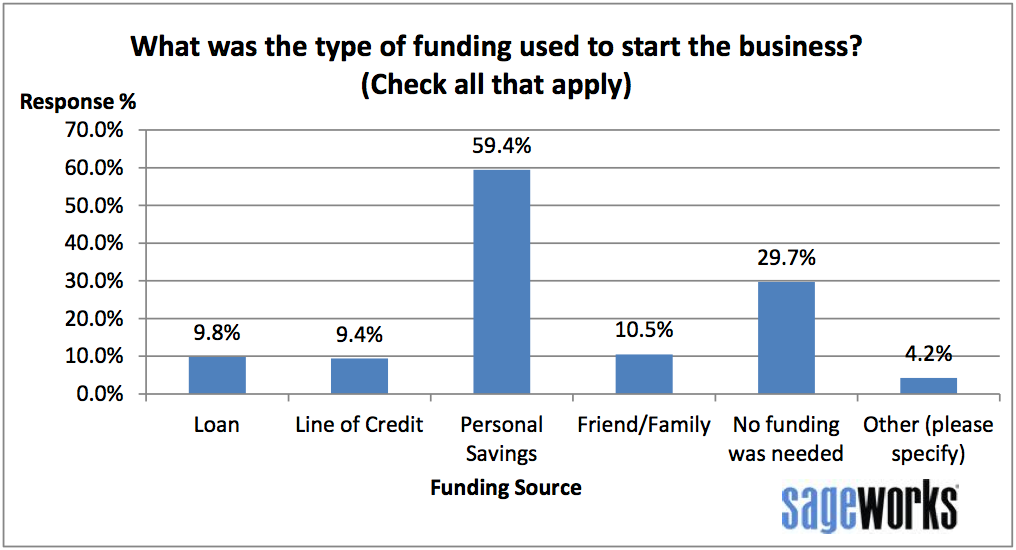

But how are business owners financing their businesses if they aren’t applying for loans? When asked how they’re starting their business operations without taking on debt, 59 percent of respondents said they used personal savings to start their business. Almost 30 percent didn’t need any funding and 10.5 percent received funding from friends or family. Just over 19 percent of respondents did rely on a loan or line of credit.

“Taking on too much debt can be harmful to a business," says Sageworks chairman Brian Hamilton. "Management starts worrying about how to pay back the loans, rather than how to really scale the business.”

That businesses currently have greater access to capital is good news, Hamilton adds, but it’s even better news that they’re being cautious about accepting that capital and taking on debt.

By: inc.com