Franchising, retail, business

15/01/2015

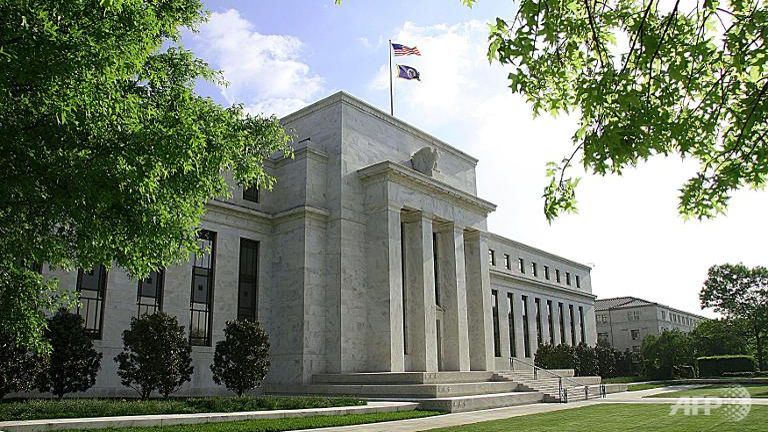

Federal Reserve officials are reporting concerns over the impact falling oil prices will have on an improving economy, according to the central bank's latest "Beige Book" report.

The economic review, which the Fed releases eight times a year, reflected hopes for better growth but noted several problem areas.

Oil prices were seen as a boon to consumers but a problem for energy companies, with the Dallas Fed reporting that Texas energy firms were projecting hiring freezes and layoffs to accompany a 15 percent to 40 percent decline in demand.

In the Kansas City region, drilling activity and capital expenditures were forecast lower, with some firms reporting difficulty obtaining credit.

At the Atlanta Fed, there were reports of high oil inventory levels across the Gulf Coast.

"Reports from the twelve Federal Reserve Districts suggest that national economic activity continued to expand during the reporting period of mid-November through late December, with most Districts reporting a 'modest' or "moderate" pace of growth," the report stated. "In contrast, the Kansas City District reported only slight growth in December. However, most of their contacts, along with those of several other Districts, expect somewhat faster growth over the coming months."

Aside from the energy sector, the Fed report noted sluggish holiday spending in the New York district, a fear confirmed in Wednesday's retail sales report showing an unexpected 0.9 percent decline for December. Broadly speaking, the report described consumer spending increases as "modest" despite a boost from sharply lower energy prices that have pushed prices at the pump to below $2 a gallon in some areas.

On the positive side, the report noted that faster growth remains the expectation as payrolls grow and credit demand increases.

The Fed has kept its short-term interest rate target near zero for the past six years, since the financial crisis hit the economy in 2008. Market participants expect at least a modest hike later in the year, though the Fed has insisted its moves will be data-dependent.

That data paint a mixed picture. Amid the hopes for growth the Fed noted "largely flat" residential sales and construction while "demand for energy-related products and services weakened somewhat, while the output of energy-related products increased."

Payrolls grew "moderately" while wage pressures were "limited to workers with specialized technical skills," according to the report.

Stock market prices edged higher after the report was released though remaining in strong selloff mode for the day.