Franchising, retail, business

20/02/2015

In 2008, the nation entered into a financial crisis widely believed to have been caused by excesses in the residential mortgage industry. By 2010, the nation thought it had put in place a series of measures that not only would resolve the crisis but would insure that it never happened again. Yet, here we are in 2015 looking at another potential mortgage crisis.

Only this time it is different. In 2008, funds flowed in waves into the mortgage industry. In 2015, it appears the funds are drying up.

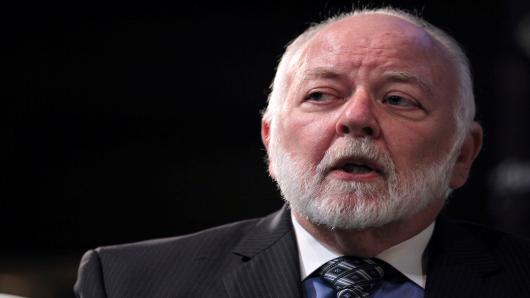

Richard Bove of Rafferty Capital Markets.

The solutions to the problem in 2010 and thereafter included:

The belief was — and is — that the market would adjust to the new and somewhat harsher conditions, and that mortgage funds would flow into housing as before. Moreover, to stimulate this flow, the Federal Reserve began buying $10 billion in mortgage backed securities every week.

At some point the rules and regulations, fines and accounting changes made it evident to many bankers that they could not make money originating mortgages. Moreover, it seemed imprudent to put 30-year mortgages, with record low interest rates, on their books. Further, the banks had no stomach for making unqualified mortgages, which could get them sued for yet tens of billions of dollars more. Plus, the Federal Reserve stopped buying mortgages and Fannie Mae and Freddie Mac began selling them.

Savvy commentators, seeing a weakening in housing activity, began opining: "It's the interest rates" ... "It's the housing prices" ... "Millennials and Generation X and Y'ers would rather rent apartments at higher prices than buy houses."

No one said: "Hey there is something wrong with the mortgage markets."

Whoops!!

No one, that is, but some people at the Federal Housing Finance Agency, the group who operate Fannie Mae and Freddie Mac. They seemed alarmed. This became apparent in two fashions:

No one cared what the FHFA was doing because no one looked — and even if they looked, they did not understand what was happening. But, things happen. Fannie Mae and Freddie Mac reported losses in the fourth quarter of 2014. These companies did not actually lose any money but, due to accounting rules, and the requirement to pay the U.S. Treasury more money in dividends than they earned, the two companies reported losses.

Now some people are beginning to get concerned. They are worried that the taxpayer may be forced to provide Fannie and Freddie with more cash. They fear more large losses could be reported by these companies.

Moreover, the people who take a close look at the balance sheets of Fannie and Freddie see that their equity is disappearing in payments to the U.S. Treasury while their guaranteed book of loans is growing. These people are beginning to understand that Fannie and Freddie are building the debt obligations of the United States government and no one is stopping them; certainly not Congress who is looking benignly on.

The dilemma is: If the policy makers stop the growth of Fannie and Freddie, they will stop the growth of housing. If they do not stop the growth, Fannie and Freddie will increase the debt obligations of the United States.

What to do??

Commentary by Richard X. Bove, an equity research analyst at Rafferty Capital Markets and the author of "Guardians of Prosperity: Why America Needs Big Banks" (2013).