Franchising, retail, business

08/05/2015

Maybe the only thing McDonald's can do to grow is to buy Wendy's.

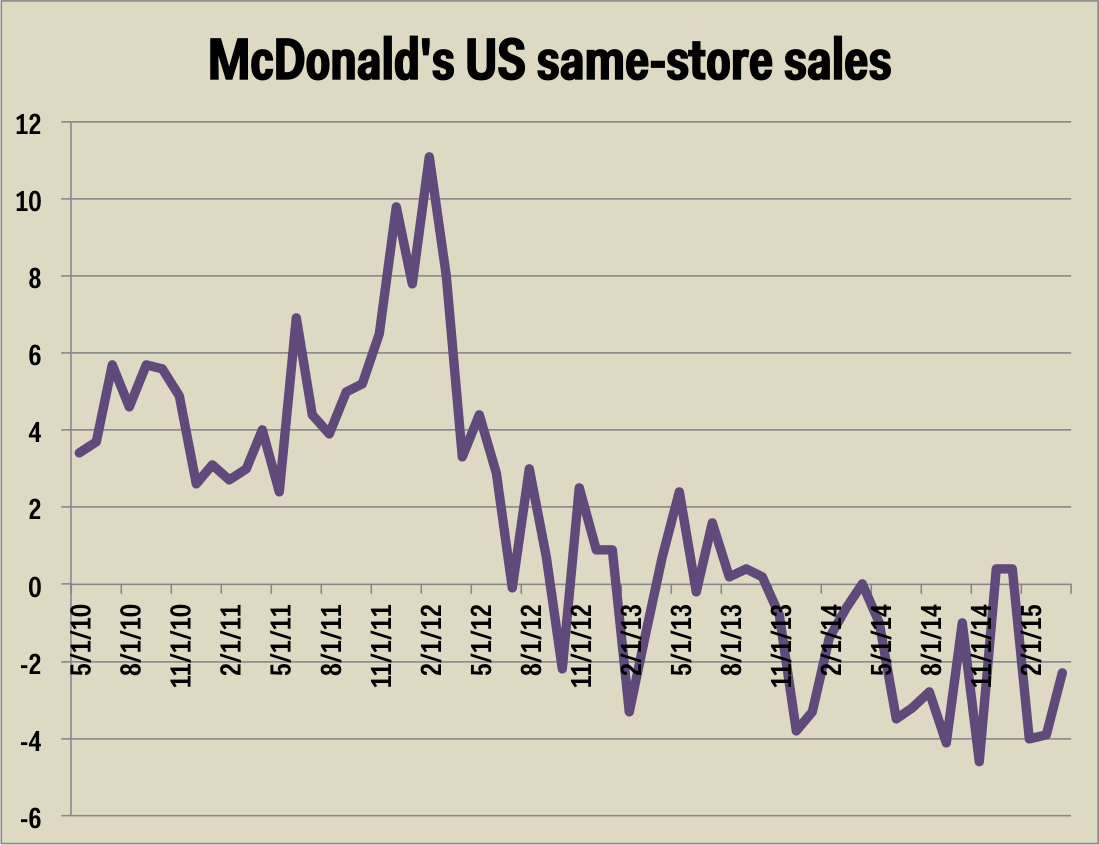

In its DB140 note on Friday, Deutsche Bank asks what's going so wrong at McDonald's, which on Friday reported that same-store sales declined again in April.

"The paradox of rising obesity levels and the increasing consumer preference for healthy food has confounded McDonald's," the firm writes. "But chewing between the lines of this week's turnaround plan reveals a possible response."

Deutsche Bank's suggestion: buy stuff.

In particular: Wendy's. Or maybe Darden (which owns Olive Garden). Or Starbucks. Either way.

Here's Deutsche Bank:

Franchises will increase from 80 to 90 per cent of total stores freeing up balance sheet, possibly for acquisitions. There are plenty of potential targets. For example, if McDonald's paid a 20 per cent premium and used two-fifths equity funding to buy Wendy's it could boost earnings per share by four per cent by 2018 before synergies. The same parameters applied to Darden Restaurants or Starbucks could double that accretion while net debt would lie comfortably under three times ebitda. The synonymy of the golden arches with the words "junk food" may force McDonald's hand. If eaters' preferences have changed for good, buying new brands may be the only option.

The simple point here is that if McDonald's is really facing a long-term crisis where sales are falling — and will continue to fall — with no real end in sight, it's going to have to buy other brands to keep earnings growing.

The most recent chart of McDonald's same-store sales in the US paints an ugly picture of a brand in decline.

Maybe the only thing left for the company to do is swallow other companies.

Fonte:http://uk.businessinsider.com/mcdonalds-needs-to-buy-wendys-2015-5?nr_email_referer=1&utm_source=Sailthru&utm_medium=email&utm_term=Business%20Insider%20Select&utm_campaign=BI%20Select%20%28Wednesday%20Friday%29%202015-05-08&utm_content=BISelect?r=US