Franchising, retail, business

07/11/2015

The housing market is misfiring badly, and a failure to boost supply will compound widespread discontent

This isn’t the first Economic Agenda column I’ve written on the UK housing market – and it won’t be the last.

Our national obsession with house prices is so ingrained that few economic issues catch the eye quite like housing supply and demand.

More fundamentally, the UK’s failure over many years to build enough homes is not only severely curtailing growth, but is also now a source of social division and rancour.

“We need a national crusade to get homes built,” said David Cameron at the Conservative party conference in Manchester last month. “When a generation of hard-working men and women in their 20s and 30s are waking up each morning in their childhood bedrooms – that should be a wake-up call”.

While the Prime Minister’s analysis is right, house completions have averaged below 120,000 annually since the Tories took office in 2010.

That’s far short of the 250,000 needed each year to cope with our own demography, let alone immigration.

UK home-ownership, still quite high by international standards, has fallen from over 70pc of households in 2001 to 63pc today. Among 25 to 34-year-olds, though, that share has plunged from 68pc to 39pc.

Only 7pc of 16 to 25-year-olds own a property, down from 37pc little more than a decade ago.

There is now an entire generation, then, most of whom are missing out on the financial and personal security that home-ownership represents. That contributes not only to falling birth rates and untold human misery – as adults remain locked in their childhood homes – but also a lower trend rate of economic growth.

Every UK recovery from recession during the last century has had at its heart a sharp rise in house building – with activity spreading way beyond construction to the broader economy.

Since the UK fell into recession after the 2008 Lehman Brothers collapse, though, we’ve staged the slowest, most unconvincing economic recovery in living memory. Over that period, it is no coincidence the UK’s house-building efforts have repeatedly hit new annual peacetime lows.

Housing completions regularly averaged almost 250,000 a year during the 1980s, falling to nearer 190,000 in the 1990s before peaking above 200,000 again over the first half of the last decade. Since 2009, though, UK-wide house building has fallen well below 150,000 a year.

As tight supply has combined with on-going demand (in part due to immigration) prices have risen and home-ownership has become impossible for increasing numbers unable to rely on generous wealthy relatives.

That’s transformed our housing market from a generator of social mobility to a source of resentment for an ever-widening share of society.

Cameron described 2014 as “the most successful year for new houses since 2008”. Yet we built just under 140,000 new houses.

The UK’s home-building shortfall has been well over 100,000 a year for seven years, on top of a less dramatic but still significant under-provision for most of the last quarter-century.

The result is spiralling rents, sky-rocketing purchase prices – and an increasing division between the property have and have nots.

Given that home-owners vote in larger numbers, and still just about represent a majority, its almost as if successive governments have been happy to see prices spiral, knowing that the resulting “feel-good factor” will garner voters in sufficient numbers, regardless of the broader impact.

House prices grew nationally by 9.7pc during the quarter to October, compared with the same a year ago, we learnt last week, with the latest Halifax survey showing the strongest annual increase recorded so far this year.

This boost reflected “growing housing demand, fuelled by improving economic conditions” but also “an imbalance of demand and supply”.

More than two-thirds of us, according to the Halifax, think prices will keep rising over the next 12 months. Again, that’s fine for those with property but, unless post-tax wages surge, further rises make home-ownership even harder for those without.

Moody’s also think house prices will keep heading upward. The projected increase in the UK population to 70m by the end of this decade, said the ratings agency in a report last week, coupled with ongoing low unemployment, will keep prices rising.

This was a view echoed by property consultant JLL in another report. Across the London and the South East, prices will go up at least 24pc over the next five years, the study said, with real estate also performing well in Manchester, Leeds, Edinburgh and Bristol.

No one can be sure if that’s true, of course. UK house prices can be volatile and some do point to the danger of a crash – not least in London.

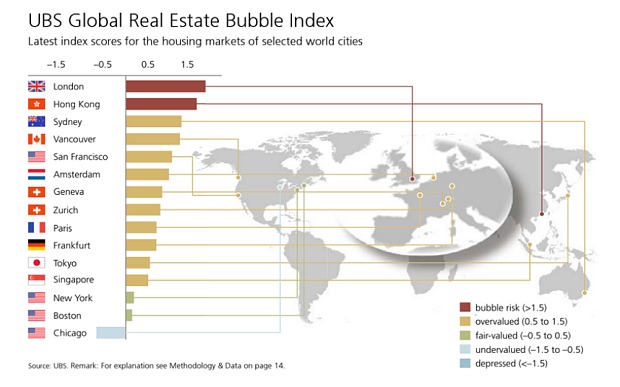

The investment bank UBS just named London as “the most over-priced housing market in the world", pointing to a “95pc chance of at least a 30pc correction in prices over the next five years”. Such precise estimates are absurd, of course. But it does strike me risks to the London property market are growing.

"London is by far the most overvalued market in Europe, at risk of a bubble as a result of explosive price behavior since 2013."

UBS

Sluggish emerging markets and lower oil prices mean there is less “top-end Arab and Russian money” coming in.

Reduced angst on Eurozone markets and a strong pound, which pushes up prices for foreigners, also makes London less attractive as a safe haven. These factors are already combining with more punitive stamp duty on expensive homes to slow down the London market.

A slightly less manic London market won’t make homes more affordable in the suburbs, though, in the South East or elsewhere.

It’s also true that that the Bank of England’s latest indication that UK rates may now not rise from their historic 0.5pc low until early 2017, a year later than previously expected, will probably push prices even higher.

While its relatively easy to point at the problem, solutions are controversial. So I know it won’t be popular when I say that the Tories should now take the plunge and advocate building on parts of the “green belt” – which currently covers around 13pc of England, 16pc of Northern Ireland and a far lower share of both Wales and Scotland.

Much of this land is unattractive urban scrub, and using it is vital to ensure enough homes are built near cities were people want to live and can find employment.

“Clearly there is land banking,” a very senior Whitehall civil servant in a position to know recently told me, referring to the cynical practice which sees developers buy land to build homes, but then sit on it, waiting years for house prices to rise further.

“This clearly compounds the inelasticity of housing supply and is a major problem,” the senior mandarin continued, pointing to the need for stricter time limits on valuable planning permission.

I’d argue that the Government’s help-to-buy scheme, which helps a limited number to purchase homes, is actually compounding the problem, by boosting demand in the face of an on-going shortage of supply.

In addition, I think ministers should consider the example of South Korea, where for several decades a state-run Korean Land Corporation has bought cheap land without residential or commercial planning permission, selling it on to private sector developers, with strict times limits, once planning permission has been granted.

The massive upside in land valuations resulting from such permission then accrues to the taxpayer.

Such gains can be used to build better local infrastructure – roads, schools, utilities and so on – while properly compensating other homeowners negatively affected. In this way, large developments can attract broader support.

A state-sponsored UK Land Corporation may sound too radical, but this is a time for bold action. The UK housing market is misfiring badly, and a failure to boost supply will compound widespread discontent, leading eventually to misguided policy interventions that are even more extreme.

By:http://www.telegraph.co.uk/finance/newsbysector/constructionandproperty/11981458/Its-time-to-build-foundations-for-a-smarter-UK-housing-market.html