Franchising, retail, business

01/08/2016

This story was delivered to BI Intelligence "Fintech Briefing" subscribers. To learn more and subscribe, please click here.

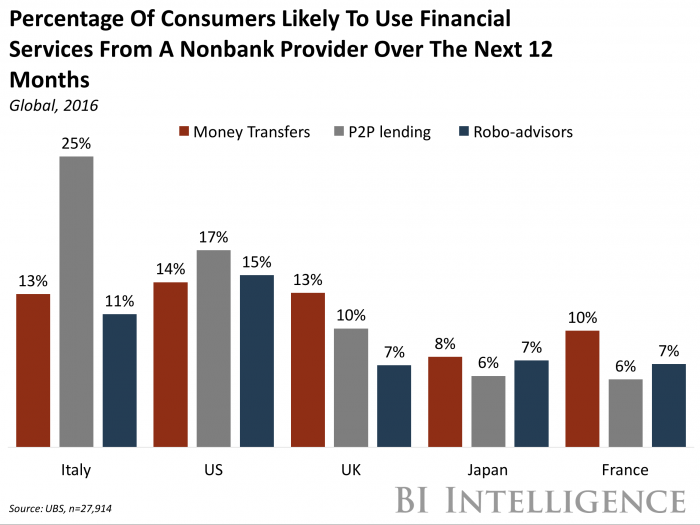

Banks in the U.S. and Italy are most at risk of disruption, according to a UBS survey of 28,000 consumers in 24 countries.

UBS based its rankings on answers to behavioral questions related to fintech. In developed markets, banks in Japan and France are least at risk. In emerging markets, banks in India are most at risk, while banks in South Korea and Poland are least at risk.

Consumer willingness to use fintech products could be due to a number of things:

Awareness. In order for customers to use or plan to use fintech products, they need to know that these products exist. Awareness, and therefore potential usage, is likely to be higher in countries where fintech products have been available for some time.

Culture. UBS notes that the low risk to French and Japanese banks is likely cultural. Though UBS doesn't provide any cultural insight in its note, we think that it may have to do with aversion to risk.

Poor banking services. Consumers are more likely to turn to fintech products when legacy financial institutions aren't meeting their needs. In Italy, for example, banks arestruggling to survive, and there are few resources available for product innovation. This may explain why it's at risk of disruption.

Lack of banking services. In countries where legacy financial services aren't available at all or large sections of the population are underbanked, consumers are more likely to turn to fintech products. We think this could be the reason behind consumer use of fintech products in India, where 47% of the population is unbanked.

UBS also identified areas of banking most at risk of disruption:

Lending. Globally, 25% of consumers say they either have a loan from a P2P lender or plan to take one out in the next 12 months. UBS notes that given the high reported adoption, respondents may have answered affirmatively for loans made through digital payments platforms like M-Pesa as opposed to digital platforms specifically designed for P2P lending. Banks' response to the threat of P2P lenders has been to partner — 29% of banks in developed markets either already have a partnership in place or plan to form one in the next 12 months. We think that the trend will continue and as banks begin to offer similar technology, demand for loans from standalone P2P lenders will decrease.

Advice. Adoption of nonbank robo-advisors is likely to grow around 150% globally over the next 12 months, according to UBS. But legacy financial services firms can easily enter this market because barriers to entry are low. A large number of legacy wealth managers and banks, including Vanguard, Charles Schwab, and RBS are already offering automated investment advice.

Foreign exchange and remittances. Nine percent of consumers in developed markets, 14% in emerging markets, and 32% in India are already using fintech services to send money overseas or for foreign exchange. Fintechs focused on remittance and holiday money offer these services at much lower costs to the consumer than legacy players. This is driving significant consumer adoption — holiday money app Revolut is just one year old and already has over 200,000 users.

These changes should particularly affect millennials, as more members of this demographic are moving toward digital banking, and as a result, they're walking into their banks' traditional brick-and-mortar branches less often than ever before.

This generation accounts for the greatest share of the U.S. population at 26% and the employed population at 34%, so it's easy to see why their behaviors and preferences will have a profound effect on the future of the banking industry, particularly with regard to the way banks interact with their customers.

Third parties are expanding their role in providing services that consumers use to manage their money. And the more that role grows, the more it will disrupt the relationship between banks and their customers.

To paint a clearer picture of the future of the banking industry, John Heggestuen, managing research analyst at BI Intelligence, Business Insider's premium research service, surveyed 1,500 banked millennials (ages 18-34) on their banking behaviors and preferences — from their preferred banking devices, to what banking actions they perform on those devices, to how often they perform them.

All of that rigorous research led to an essential report entitled The Digital Disruption of Retail Banking that dives deep into the industry and details what its future will look like.

Here are some of the key takeaways from the report:

The bank branch will become obsolete. It will be some time before the final death rattle, but improving online channels, declining branch visits, and the rising cost per transaction at branches are collectively leading to branch closures.

Banks that don't act fast are going to lose relationships with customers. Consumers are increasingly opting for digital banking services provided by third-party tech firms. This is disrupting the relationships between banks and their customers, and banks are losing out on branding and cross-selling opportunities. For many banks, this will require further commoditization of their products and services.

The ATM will go the way of the phone booth. Relatively low operational costs compared to bank branches, paired with customers' preference for in-network ATMs, makes the ATM an attractive substitute for bank tellers. But as cash and check transactions decline, the ATM will become nonessential, ultimately facing the same fate as the physical branch.

The smartphone will become the foundational banking channel. As the primary computing device, the smartphone has the potential to know much more about banks' customers than human advisors do. The smartphone goes everywhere its user goes, has the ability to collect user data, and is already used for making purchases. Therefore, the banks that will endure will be those that offer banking services optimized for the smartphone.

In full, the report:

Analyzes how millennials use bank branches and why - even though there are a large share of millennials who still use branches, making significant investments in these channels isn’t a good move for banks.

Explains how mobile payments and mobile point-of-sale adoption by small retailers will make the ATM obsolete.

Describes how digital channels, particularly the smartphone, will become the foundation of the bank-customer relationship.

The Digital Disruption of Retail Banking is how you get the full story on the future of banking.

To get your copy of this invaluable guide, choose one of these options:

Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of how the digital age will disrupt retail banking.