Franchising, retail, business

28/03/2017

Amazon's stock price has been on a tear over the last year, gaining 46%.

A Barclays equity research team led by Ross Sandler thinks that the party may just be getting started, initiating coverage of the stock with $1120 price target, or 29% upside.

In a flurry of notes released from their Internet & Media desk on March 29, Barclays picked Amazon as one of their favorites in the sector and made the case for the stock's market cap to reach one trillion dollars.

"Net/net, AMZN is likely to be one of the first trillion-dollar market cap companies; it’s just a question of when, not if, in our view," the team wrote. "AMZN is arguably the best story in the space, with the most open-ended growth opportunity & most highly functional organization."

Barclays says that while Amazon Web Services is past its infancy, it has penetrated only 1% to 2% of the potential market and eventually will be a $100 billion business.

Right now, "AWS generates the bulk of its revenue in servers and storage, where Gross Margins are lower than other layers up the technology stack." Amazon can increase margins by focusing on areas like application software and business intelligence.

On the retail front, Barclays notes that margins have been under pressure; however, it sees big investments in infrastructure, such as the possibility of "ramping its fleet of air cargo planes from 100+ to 500+ in the future," eventually paying off.

Overall, Amazon's retail business continues its tremendous growth , recording $35 billion in gross profit during fiscal year 2016, up from just $9 billion five years ago. Barclays sees this number reaching $80+ billion by 2021.

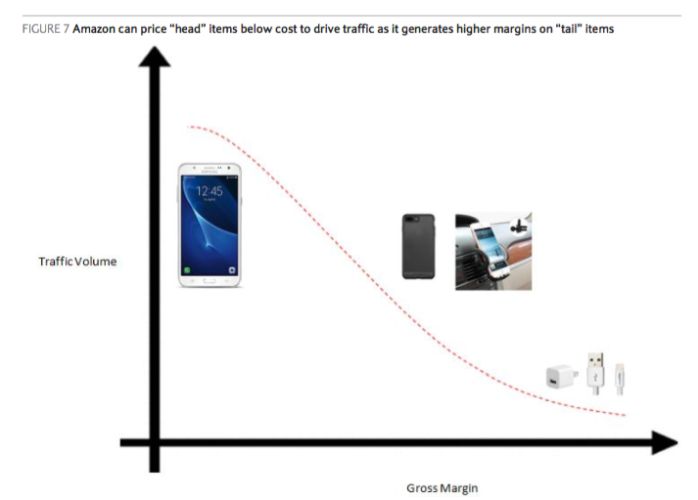

Barclays noted the success of Amazon's "head' and "tail" product strategy. This is when Amazon drives traffic and volume to the site by aggressively pricing certain hot items like Echo and various electronics, sometimes below cost, then makes up for those lost margins with high margin "tail" items like cases, charges, batteries, etc.

As for Amazon Prime, Barclays loves it, declaring:

"Prime has been one of the biggest transformations in the Retail business, perhaps the biggest, in the past several years. Prime is the glue that holds everything together, from customer to merchant loyalty and retention. Prime drives higher purchase frequency and allows Amazon to bundle many services that its competitors are unable to provide, further extending the moat around the Retail franchise."

The bank thinks that Amazon could reach 200 million Prime members by 2021. Currently there are about 75 million.

Greg Hoffman

Markets Insider

Fonte:http://markets.businessinsider.com/news/stocks/amazon-stock-price-march-29-2017-2017-3-1001879044?IR=T&utm_source=Triggermail&utm_medium=email&utm_campaign=BII%20Daily%20%282017.3.29%29&utm_term=BI%20Intelligence%20Daily%20-%20Engaged%2C%20Active%2C%20Passive%2C%20Disengaged