Franchising, retail, business

10/12/2014

It’s no secret that investment banks experience significant turnover at the completion of their analyst programs. Some burnout, some are let go and others move industries after earning five years of experience in a two-year stretch. Investment banking can open a lot of doors, and many bankers walk to the buy-side.

In fact, more analysts left to go to the buy-side than actually remained at their own bank, according to analysis from recruitment startup Vettery of roughly 1,400 IBD analysts who joined Wall Street in 2012.

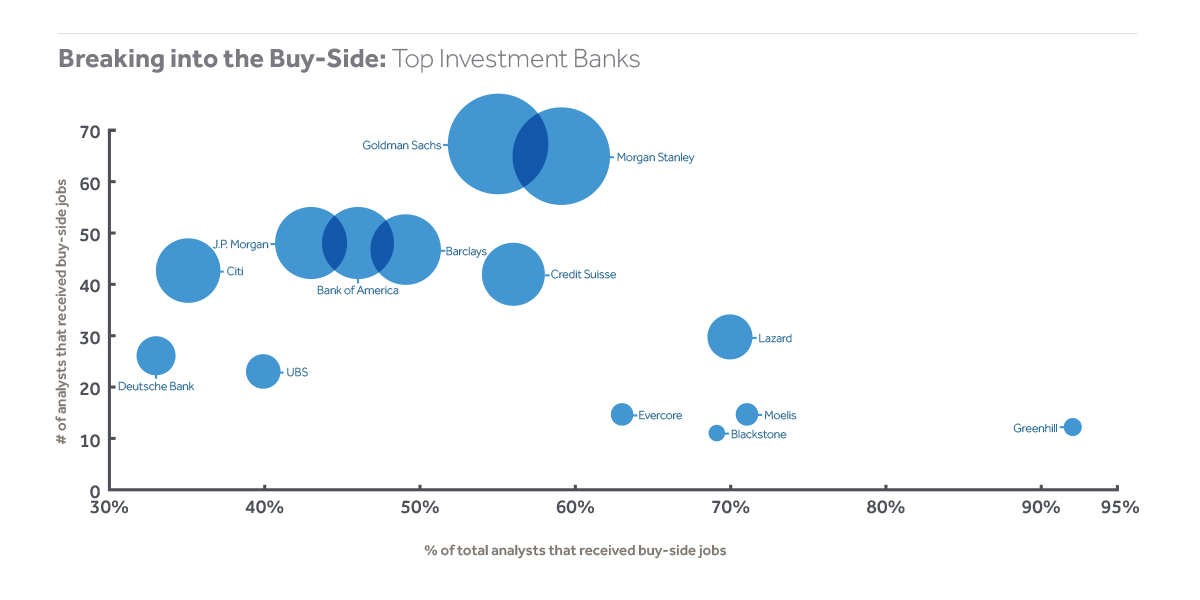

But not all banks saw an equal flow of talent to the buy-side. Goldman Sachs and Morgan Stanley are by far the happiest hunting grounds for private equity firms looking to poach analysts. At Goldman, roughly 55% of its 2012 analyst class moved to the buy-side. That number reached 59% at Morgan Stanley. The sheer number of people who left also led all bulge bracket banks.

Could it be an indictment of the two firms, as more of their analysts are pouring out the door? Or is it a compliment of sorts considering the majority of investment bankers seem to be angling for jobs on the buy-side, and theirs are the ones who are rising to the top? Clearly, they are recruiting smart, well-trained and impressive candidates. But they are also losing them at higher rates than the competition. Alarming rates, really.

Either way, bulge bracket banks aren’t the best incubators for buy-side opportunities. It appears to be the boutiques that offer the clearest path to the buy-side. While the sheer number of analysts who departed boutiques for buy-side firms is relatively small, simply due to their size, the percentage who leave is staggering.

More than 70% of young boutique bankers found their way to hedge funds and private equity firms following their analyst program, compared to 47% for bulge bracket banks, according to the research.

Other interesting facts from the report: UBS didn’t come out looking very well. Around 40% of graduating analysts found work on the buy-side, but an eye-opening 30% left the firm to join another investment bank. As a point of comparison, only around 10% of respondents across all banks made lateral moves.

Also, if you want a buy-side job where the action is (and the pay is likely better), you best find work at a tier-one bank. Almost two-thirds of analysts at second-tier banks who found work on the buy-side took jobs outside of New York. Vettery said it derived the numbers from publicly-available sources using proprietary data mining techniques.

The U.S. data backs up an earlier European report that found PE firms recruited 40% more junior bankers from investment banks and consultancies than they did two years ago. Plus, more than 80% of European private equity firms increased their base salaries, according to Financial News.