Franchising, retail, business

25/05/2016

Technically speaking, America’s economic recovery from the Great Recession is in its seventh year, making it one of the longest expansions on record. The unemployment rate is falling, businesses are hiring and there are finally some signs that wages are rising.

But for so many households, that progress still feels painfully remote.

The Federal Reserve surveyed more than 5,000 people to determine whether their personal situations were improving along with the economy. The results, released Wednesday afternoon, found that though households showed “mild improvement” overall, their perspective depended on their income, race and education.

Take this one telling statistic: About 46 percent of Americans said they did not have enough money to cover a $400 emergency expense. Instead, they would have to put it on a credit card and pay it off over time, borrow from friends or family, or simply not cover it at all.

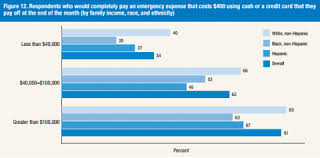

Not surprisingly, those with higher incomes were better equipped to handle an emergency. About 81 percent of people making more than $100,000 a year reported they would be able to cover the bill, compared with 34 percent of those earning less than $40,000.

At every income level, white consumers were better prepared for a $400 emergency than other racial groups. Eighty-three percent of the wealthiest whites surveyed said they could easily absorb the cost, compared with 63 percent of blacks and 67 percent of Hispanics in the same income group. Among the poorest consumers, 40 percent of whites would be able to cover the expense compared with 20 percent of blacks and 27 percent of Hispanics.

Still, the total percentage of people who would struggle in an emergency expense has improved over the past few years. This is the third time the Fed has conducted this survey, and the number has dropped from 50 percent in 2013 to 46 percent last year.

There were also other reasons to be hopeful: The survey found people are 9 percentage points more likely to say that their financial well-being has improved over the past year than to say that it has declined. And the number of people who say they have the skills to get the jobs they want has jumped from 67 percent to 77 percent over two years.

But the report also makes clear that many of the country’s most vulnerable households have yet to feel the benefits of the broader economic recovery. Let’s hope it doesn’t take another seven years before it trickles down.

Fonte:https://www.washingtonpost.com/news/wonk/wp/2016/05/25/the-shocking-number-of-americans-who-cant-cover-a-400-expense/