Franchising, retail, business

10/06/2016

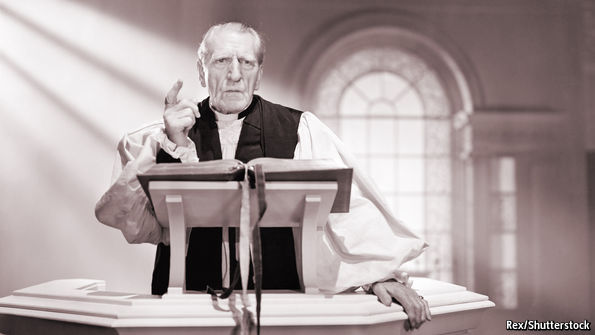

THERE is an old story that puritanical Scottish preachers used to tell their congregations about sinners cast into the fires of hell. The condemned call out to the Almighty for mercy who replies “Did I not tell you to abandon your lives of drinking, fornicating and sinning?” “Yes, lord” comes the pitiable reply “but we didna ken.”* “Well” comes the implacable reply “Ye ken noo.”

The British vote on the EU is remarkably close despite the parade of experts—the Bank of England, IFS, IMF and OECD, as well as the vast majority of economists—who have pointed to the potential adverse effects. The problem is that many voters simply don’t believe the experts, especially in the wake of the 2008 crisis. And the Conservatives in the Leave campaign, who cheerfully cite such experts when attacking Labour party policies during general elections, now disdain them altogether. Similarly when business leaders pronounce for Remain, their views are dismissed by Tories who normally treat the needs of business as pretty sacrosanct.

Cite those strategists who say that sterling or the markets will fall after a Brexit and people will say “The bankers got it wrong before”. Well David Bowers and Ian Harnett of Absolute Strategy Research are independent researchers and their view is

For sterling, the risk is revisiting parity vs the US dollar should the UK exit. For equities, investors might demand 100bp more yield, implying close to a -20% adjustment.

Of course, the markets are not the most important thing in life but the projected falls reflect the likely hit to confidence and thus economic activity that would follow a decision to leave. Can one prove this will happen? Of course not, just as those Scottish sinners ignored their preachers while they were alive. Is it all priced in anyway? It is hard to disentangle Britain’s market movements from the global trend; bond yields are plunging. The FTSE 100 is down 2% today with some citing the impending vote. If the gambling markets are anything to go by, investors still think Remain will win; a Leave vote is currently 11/4. Absolute Strategy, based on the betting markets, thinks the implied probability of Brexit is only 24%.

And what is the plan if we leave? As far as we can tell from Boris Johnson, who struggles with the facts, there isn’t one. He will mutter “Carpe diem” or whatever Latin phrase comes to mind (Festina lente? Sic transit Gloria mundi?). We don’t know if we will end up with a Norway-style link (in the single market, and still with freedom of movement) or with a Canadian style deal (no freedom of movement and restricted access for the services sector). Labour politicians are just waking up to the fact that a post-Brexit government led by Michael Gove and Boris Johnson will not be friendly to workers’ rights; those EU regulations they want to sweep away include labour market protections. Labour voters will only find that out, of course, if they vote Leave.

There was another example of the contradictions in the Leave camp yesterday when Tony Blair and John Major warned of the impact on Northern Ireland if Britain exits the EU. Currently there are no border controls between southern and Northern Ireland. So our options if we leave are:

1) continue with no controls (which Leave says will happen)

2) take control of our borders (which Leave also says will happen)

Both can’t be right. As far as I can tell, Leave claims that the Irish can be relied upon for our security, and that migrants won’t come across the border because they won’t have the permits to work. Your blogger is all in favour of immigration but this seems the flimsiest of arguments. If work permits are all we need to control borders, how come we have to stand in long lines at Heathrow? And if the Irish are in control of our borders, then Britain is not.

Anyway, the shoddy reasoning may win out in the end. And then people will complain later in 2016 when jobs are lost and the purchasing power of their pounds declines, and say that no-one told them such things might happen. And it will give the rest of us no satisfaction at all to say “Ye ken noo”.

* For those unfamiliar with the Scottish dialect, they are saying “We didn’t know”. And God replies “Well, you know now.”

Fonte:http://www.economist.com/blogs/buttonwood/2016/06/eu-referendum-0?cid1=cust/noenew/n/n/n/20160613n/owned/n/n/nwl/n/n/n/email