Franchising, retail, business

05/07/2016

Italy is on the cusp of tearing Europe apart but the economic and political crisis brewing in the nation is largely going unnoticed.

All eyes have turned to Britain's vote to leave the European Union as having the most drastic political and economic impact onto the 28-nation state but if you look at the country's economic data, bank issues, and the impending constitutional referendum coming up, Italy is like a bomb waiting to explode.

The Italian financial system, which to put it gently, is in a major state of flux right now. While Britain's EU referendum in June was seismic in terms of having economic and political repercussions across the bloc, there is another referendum of equal importance, coming up in Italy in October, and the result could fundamentally alter the state of the already delicate Italian economy.

Italians will have a say on reforms to its Senate, the upper house of parliament, in October. The proposed reforms are widespread, and if approved could improve the stability of Italy’s political set up and allow Prime Minister Matteo Renzi to push through laws aimed at improving the country’s economic competitiveness.

If denied, Renzi’s government will most likely fall, plunging Italy back into the type of political chaos last seen after the ousting of former Prime Minister Silvio Berlusconi, according to Deutsche Bank. That, Citi says, makes the referendum "probably the single biggest risk on the European political landscape this year among non-UK issues."

“If the referendum is rejected, we would expect the fall of Renzi’s government. Forming a stable government majority either before or after a new election could become extremely challenging even by Italian standards,” Deutsche Bank analysts led by Marco Stringa said in a note to clients in May. Fears that the reforms will be rejected have intensified since the eurosceptic vote won in Britain.

A political mess can quickly turn into a cornucopia of financial and economic disarray. According to estimates from business lobby Confindustria, if Renzi's reforms do not pass, it would push Italy into recession, lead to massive capital flight, and widen spreads on Italian debt.

A political mess can quickly turn into a cornucopia of financial and economic disarray. According to estimates from business lobby Confindustria, if Renzi's reforms do not pass, it would push Italy into recession, lead to massive capital flight, and widen spreads on Italian debt.

Italy simply cannot afford any of those things at the moment.

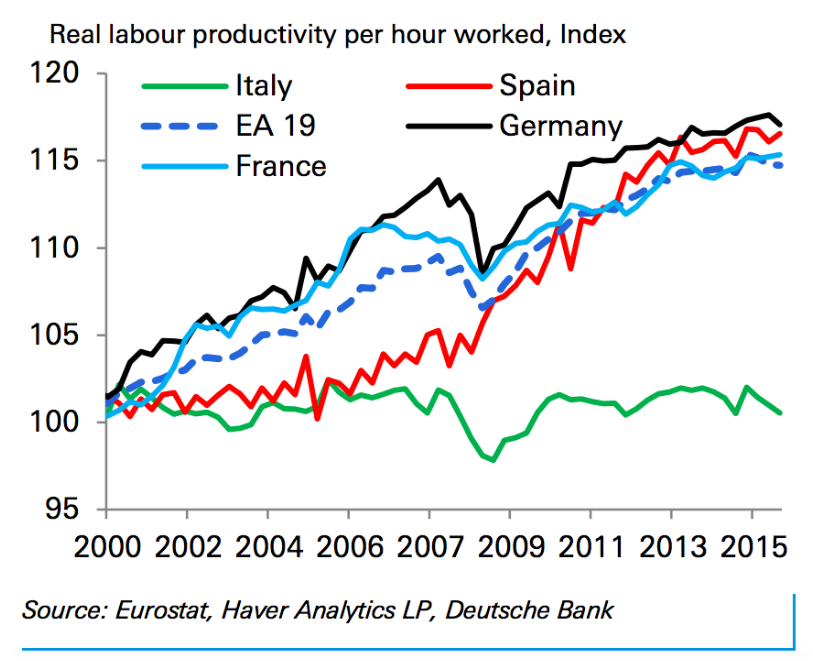

Not only is the country in a state of economic and political turmoil — it has crushingly low productivity, a history of missing growth targets, and has generally underperformed the rest of Europe in recent years — but the country's banking system is also in the midst of serious, serious problems.

"One theme which could dictate near term direction for markets and which arguably Brexit has reignited and brought back to the forefront is the ailing and fragile state of the Italian banking sector," Deutsche Bank's Jim Reid noted in his daily Early Morning Reid on Tuesday.

The country's financial sector is plagued by an enormous surfeit of bad loans so great that the government was, in April, forced into rallying bank executives, insurers and investors to put €5 billion (£4.2 billion, $5.57 billion) behind a rescue fund for its weakest banks. The Atalante fund is designed to buy so-called bad loans from lenders and invest in their shares in the hope that the re-energized banks will lend more to businesses and spur growth.

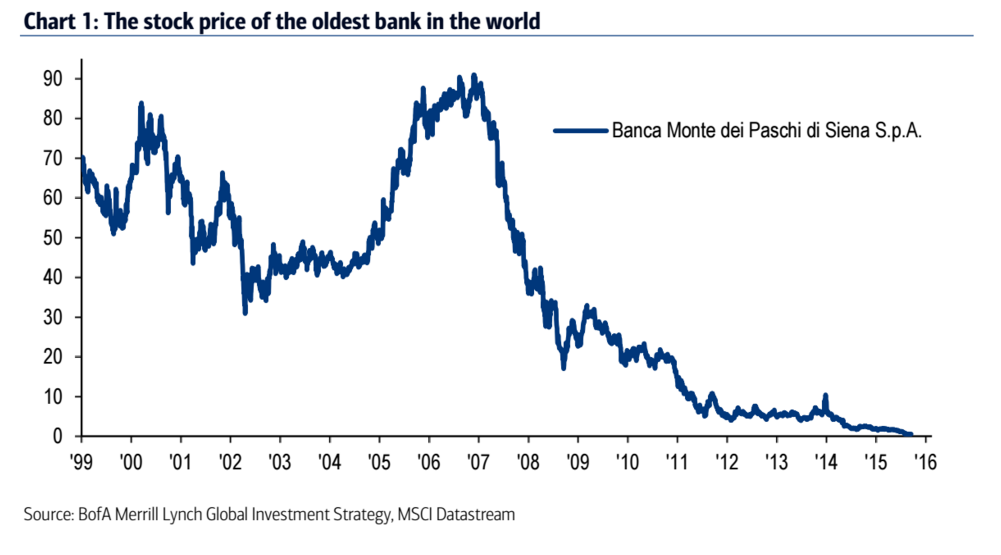

However, Monte dei Paschi di Siena — the oldest bank in the world and weakest bank in Italy— is in possession of a bad loan book of around €47 billion (£39.9 billion) right now, and that has got the European Central Bank very worried. On Monday, the ECB's banking supervisor insisted that Monte dei Paschi must cut that book by €8 billion by the end of 2017, and by another €6 billion by the end of 2018.

“The bank has immediately initiated discussions with the European Central Bank in order to understand all the indications included in this draft letter, and to present its reasoning before the final decision, expected by the end of July 2016,” Monte Paschi said in response to the ECB's demands.

The news sent shares in all of Italy's banks substantially lower, with Monte dei Paschi understandably bearing the brunt of the falls. Shares dropped more than 8% on Monday to just 0.3 cents, valuing the bank at €1 billion, according to the Financial Times.

Here is the incredibly depressing chart from Bank of America Merrill Lynch:

In total, the financial sector in the country has roughly €300 billion of 'bad' debt, which needs to be addressed one way or the other. This might not be such an enormous problem if it was not for the fact that, as previously mentioned, Italy's economy is chronically weak. This in turn affects the ability of the country's government to provide a viable bailout package for the banking sector. Government debt in Italy now stands at almost 140% of GDP, second only to Greece in eurozone in gross terms.

Online publication This is Money suggests that despite the assertions of Renzi that he is ready to provide assistance to bail out underperforming banks, Italy is actually around €35 billion short of having the required capital to do that.

There are now serious fears in Brussels, according to the Financial Times, that the Italian government will not be able to fund a rescue package for the banking sector.

That has led to Italy going to Brussels for assistance, something that has so far been rejected, as it would be in contravention of EU rules.

"We have established specific rules as far as recapitalisation of the banks is concerned," German chancellor Angela Merkel said over the weekend.

"We can’t come up with new rules every two years. The Commission is ready to help, but so far it has not been convinced by what has been proposed by Italy."

Despite that rejection, Renzi — who is now known in some circles as the "Demolition Man" for his efforts to shake up the Italian political system — is reportedly ready to bypass the EU and act unilaterally to protect the financial system.

"We are willing to do whatever is necessary [to defend the banks], and do not rule out acting unilaterally, although that would only be as a last resort," a source "familiar with the government’s thinking" told the FT. Renzi himself has said he will not be "lectured by the schoolteacher."

While several suggestions have been made — including boosting the size of the Atlante fund, and launching a separate fund, a sort of spin-off to Atlante, that will look to specifically buy up bad loans issued during Italy's last recession — it currently looks like there won't be a concrete solution to the banking crisis any time soon.

Add to this the fact that any fix created could get totally dismantled if Renzi and his party lose the reform referendum and the government falls. The Italian financial system is teetering on a precipice without much hope of a solution. Brexit may be the biggest problem facing Europe right now, but Italy isn't far behind.

Fonte:http://uk.businessinsider.com/italys-political-and-economic-crisis-threatens-europes-stability-2016-7?nr_email_referer=1&utm_content=BISelect&utm_medium=email&utm_source=Sailthru&utm_campaign=BI%20Select%20%28Tuesday%20Thursday%29%202016-07-05&utm_term=Business%20Insider%20Select?r=US&IR=T