Franchising, retail, business

03/04/2014

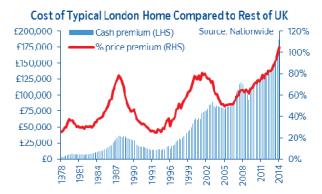

London’s surging property market widened the price gap with the rest of the UK to record levels, according to Nationwide’s latest figures.

First quarter figures showed average London house prices rose 18 per cent in a year, with the cost of a typical home in the capital being £362,699 – more than twice the level of the rest of the UK when London was excluded.

At the previous 2007 peak, homes in the capital were worth roughly 40 per cent more. The data has fuelled growing concerns about a property bubble in London where investors have been piling into the market in search of yield that they cannot find in other asset classes.

Moreover, the ripple effect of London’s booming market is driving rapid house price growth in a ring around the capital. With annual growth rates of more than 13 per cent, the affluent, and commutable cities, of Oxford, Cambridge and Brighton take three of the top four slots for price increases outside London, according to the latest Nationwide house price index. Outside the southeast, the picture is very different. Although rising consumer confidence and improving lending conditions saw prices rise in all regions in the first quarter, for most areas, these followed years of stagnation and decline. Residential property consultancy Hometrack’s analysis of 3,000 postcode districts showed 78 per cent of markets in the UK aremain below peak levels, with 41 per cent still 10 per cent or more below peak.

Outside the southeast, the picture is very different. Although rising consumer confidence and improving lending conditions saw prices rise in all regions in the first quarter, for most areas, these followed years of stagnation and decline. Residential property consultancy Hometrack’s analysis of 3,000 postcode districts showed 78 per cent of markets in the UK aremain below peak levels, with 41 per cent still 10 per cent or more below peak.

Richard Donnell, director of research at Hometrack, said the housing market recovery was fundamentally about demographics – and low interest rates.

“It is a credit story, it is all about the people in the local market and their access to finance,” he said.

“A lot of this recovery is concentrated in the higher demographic areas, the higher managerial professions. Growth just doesn’t seem to be happening in the mid-market”.

“In the big regional cities prices are starting to pick up but it is from a low base,” he added.

Manchester – the only city outside the southeast to make Nationwide’s list of the fastest growing areas – is a good example. While growth year-on-year was an exuberant 18 per cent, the typical house was still worth 4 per cent below 2007 levels at £211,748.

But Manchester is substantially outperforming its wider region: in the northwest as a whole, houses were still more than 12 per cent below peak.

Melanie Bowler, an economist at Moody’s Analytics, said the pick-up outside London was still “very tentative”.

For homeowners in properties where values have fallen sharply, and are often in negative equity “the demand to move house is still very weak,” she said.

In London, price growth is no longer being driven by prime central areas: instead it is fuelled by poorer, urban boroughs. Hackney, the second most deprived borough in the country, has seen a 23 per cent rise in the past year, compared to more genteel Richmond’s 10 per cent. “We are wondering whether this level of price growth in London is sustainable,” said Susan Emmett, director of residential research at Savills, the estate agency.

Matthew Pointon, property economist at Capital Economics, while admitting that some central boroughs like Hackney were in boom territory, argued this wasn’t the case for the UK, or even London, as a whole.

“We are seeing some evidence of slowdown, new buyer enquiries have dropped off, and a bit of a dip in mortgage lending, so there is some evidence things are not accelerating out of control which we would expect to see in a bubble situation,” he said.

By: Financial Time